Financial guidance and support, tailored for you.

Explore the benefits of working with a dedicated wealth team.

Insurance premium financing is a way for high net worth individuals and families to pay life insurance premiums without using cash or liquidating assets.

An irrevocable life insurance trust (ILIT) usually serves as the borrowing entity, since the death benefit is not included in the insured’s taxable estate.

High interest rates and market volatility are two risks associated with insurance premium financing. An experienced lending team can help you navigate the complexities of this specialized loan.

Life insurance plays a key role in the estate plans of many high net worth families. Proceeds from a permanent life insurance policy can offset estate tax liabilities for families with large estates. In addition, these proceeds can provide the funds necessary to pay estate taxes without liquidating a closely held business or having to sell illiquid assets.

Often, the challenge is determining the most effective way to pay the policy’s premiums. Insurance premium financing is one option for many of these families.

Insurance premium financing is a way for high net worth families to pay insurance premiums without using cash on hand or liquidating assets that are generating a high return. These might include investment securities, real estate or shares in a closely held business.

“Premiums for permanent life insurance policies can be quite large,” says Holly Buchanan, insurance premium finance banker with U.S. Bank Wealth Management. “By using insurance premium financing, families don’t have to liquidate high-performing assets. Instead, the assets can remain where they are and continue to grow.”

“For most families, the biggest benefit is that they can pay insurance premiums without adversely affecting their cash flow.”

Holly Buchanan, insurance premium finance banker, U.S. Bank Wealth Management

According to Buchanan, many people don’t realize how quickly estate taxes must be paid after death. “Estate taxes are usually due nine months after death, so families need to plan ahead of time how these taxes will be paid,” she says.

Families usually establish an irrevocable life insurance trust (ILIT) to serve as the borrowing entity, since the death benefit is not included in the insured’s taxable estate. The guarantor can be a non-borrowing individual, the ILIT or the pledger if not restricted by estate and/or tax issues.

Whole life or indexed-universal life insurance policies are typically used for insurance premium financing, since they usually have high early-cash value versions.

You must go through a medical underwriting process, which may be done at the same time as the loan application process. You pledge collateral to support the loan, such as liquid assets or the insurance policy’s cash value. You must provide full financial disclosure, including:

The ultimate source of loan repayment must be identified, which cannot be the life insurance policy’s death benefit. However, you could repay the balance from the policy’s cash value.

Periodic interest (but not principal) payments are required throughout the term of the loan, which can be substantial on a high-value policy.

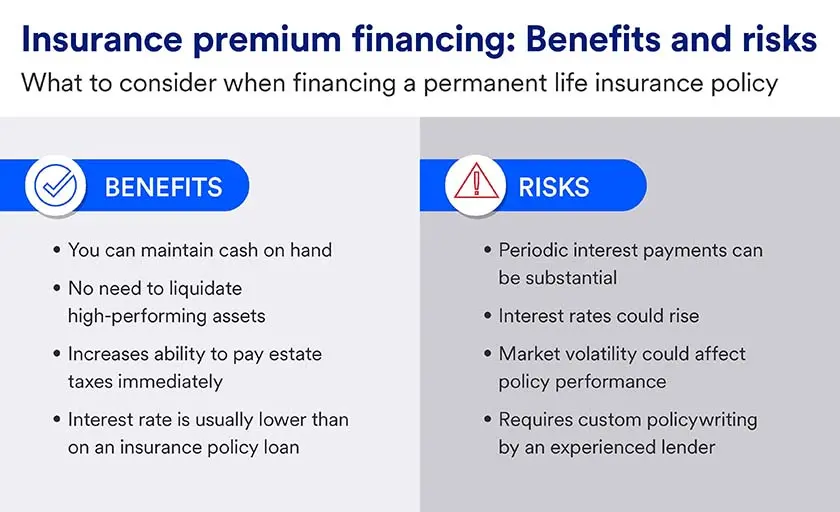

Buchanan says that insurance premium financing offers several benefits for high net worth families in the right circumstances.

“For most families, the biggest benefit is that they can pay insurance premiums without adversely affecting their cash flow,” she says. “They don’t have to sell appreciating assets, which could potentially trigger a taxable event. Also, the interest rate is usually lower than the rate on an insurance policy loan.”

There are also some risks you should consider before implementing this strategy. These include high or rising interest rates and policy underperformance due to market volatility.

“Clients should plan ahead for these possibilities and understand how they could affect their overall financial situation,” says Buchanan.

One common myth about insurance premium financing is that it is “free” insurance because the loan can be collateralized fully by the cash value. This misconception is usually based on overly optimistic assumptions about policy performance and interest rates.

Another misconception is that the policy loan can be repaid from the death benefit.

“It’s important to have an exit strategy from the policy other than death,” says Buchanan. “As we have seen recently, market conditions and the policyholder’s financial situation can change quickly and without warning, which makes upfront planning critical.”

Insurance premium financing is a highly specialized loan, so it’s important to choose the right lender. Buchanan recommends finding a lender that has a dedicated premium financing team and performs custom, instead of off-the-shelf, underwriting.

“Expertise is critical to success when it comes to this specialized type of lending,” she says.

Learn more about customized loan options available through U.S. Bank Wealth Management.

It’s typically best to remove life insurance from your estate for taxation purposes, but there are still a number of ways you can use life insurance to benefit your loved ones after you’re gone.

Access to dedicated bankers, customized financing options and exclusive benefits that support your personal and business banking needs.