How owners are navigating a changing business environment

U.S. Bank surveyed 1,000 small business owners to explore the top macroeconomic challenges they’re facing, the ways they’re using digital tools and AI, and how they’re thinking about their legacy. Keep reading to learn more.

SURVEY ARCHIVE

Top macroeconomic stressors

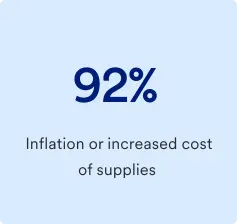

Owners report feeling the most stress around economic factors, particularly those tied to national and/or local economic environment. Based on the 2025 survey of small business owners, these are the top economic factors1 impacting their operations:

Small business owners are embracing generative AI

Generative AI is becoming an important part of small business operations. It can help improve efficiency, cut costs and provide new perspectives. Over a third (36%) of owners are currently using generative AI solutions, and another 21% are planning to implement these solutions2in the next 12 months.

Small business owners are using Gen AI most often for:3

Small businesses are accepting newer forms of payment4

Business owners are turning to new payment methods to serve their customers. While cash remains king, new payment solutions have entered the market and have been gaining popularity.

Owners have identified the primary forms of in-person payments they accept:

Small business owners would make the same decision again today

Even with macroeconomic stressors, owners love what they do and would do it all over again. According to the small business owners survey,570% believe it’s a good time to launch a small business, and 80% would still start their business today if given the chance.

When asked why they started their business, the top answers among owners were:

To be their own boss

To gain control over their financial future

To leverage their deep expertise in a specific industry

To make their passion a part of their work

Planning for what’s next: succession, legacy and the road to retirement

46% do not yet have a succession plan

62% find the process of succession planning overwhelming

53% lack the proper resources or guidance to plan for the future of their business

Plan to transition their business to their children or another family member

Plan to transition ownership or sell to a business partner or their employees

Plan to sell their business to someone outside their organization or family

Plan to gift their business to someone outside their family or company

About the research

20-minute survey among 1,000 U.S. small business owners with annual revenue of $25 million or less and between two and 99 employees. Fielding for this study was conducted from March 14, 2025 – April 4, 2025, and the margin of error is ±3.1% for the U.S. owners.

Disclosures

- Q4: Which of the following are top stressors related to your business

- Q7b: Which of the following solutions does your business plan to implement in the next 12 months

- Q8b: In which of the following ways are you leveraging Generative AI

- C5. Which of the following forms of payment does your business accept

- Q15: How much do you agree or disagree with the following statements about the current conditions for starting a small business

- Q16: Thinking about the future, at what age do you plan to retire

- Q17: You mentioned you plan to retire by the age of [Q16 Response], how confident are you that you will be able to retire by that age

- Q19: Do you have a succession plan for your business

- Q20: What is your succession plan for your business