Bring your financial future into focus.

A wealth plan can bring clarity to your financial life and help you prepare for life’s successes and uncertainties. We start by getting to know you and your unique needs, goals and passions. Then we partner with you to design a personalized plan that aligns with your vision for the future and brings your entire financial picture into focus.

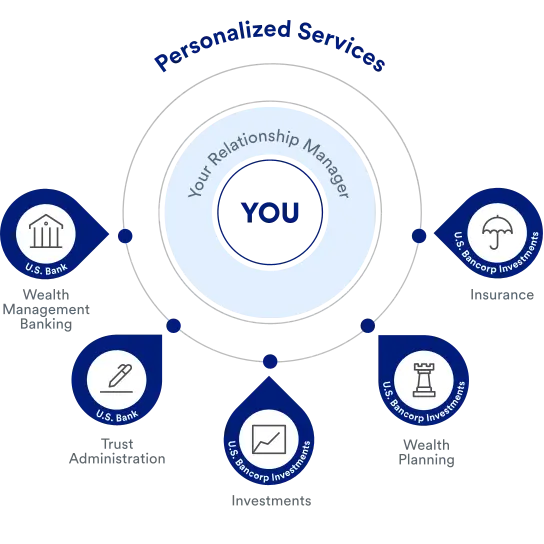

A single point of contact, supported by a team

Experience personal, one-on-one guidance from a trusted Wealth Management Advisor from U.S. Bancorp Advisors. Your advisor will partner with U.S. Bank wealth specialists in areas such as banking, and trusts and estates, to help you create a complete wealth plan. Our approach offers the convenience of a single point of contact and the knowledge of an entire wealth team – all working together toward your unique goals.

Benefits

Everyday benefits and rewards

You’ll have access to U.S. Bank banking benefits such as:

- Waived fees on many everyday banking transactions with U.S. Bank Smart Rewards® and a U.S. Bank Smartly® Checking account1

- Higher limits for mobile check deposit, money movement, ATM withdrawals and purchases

- Easy access to your accounts through online and mobile banking

Special products and pricing

Enjoy special U.S. Bank banking products and pricing including:

Flexible engagement and planning options

Engage U.S. Bancorp Advisors on your terms:

- Online access to wealth-planning tools and resources

- Live support from your advisor-led team

- Ongoing financial reviews to discuss opportunities and make adjustments

Build your financial future with confidence

Your financial goals are within reach. The next step is a conversation with a Wealth Management Advisor from U.S. Bancorp Advisors.

Not sure what to expect from your first meeting? Our guide helps you prepare with key questions to ask and a checklist of what to bring, ensuring you start your relationship with clarity.

Wealth services for what matters most

Whatever your financial goals, from funding a child’s education to planning for retirement, our services can help you move forward.

U.S. Bancorp Advisors offers:

- Investment management

- Wealth planning

- Insurance

U.S. Bank provides:

- Trust and estate services

- Banking

Explore our news and insights

Market news

Read our up-to-date reports on economic events and news from the markets.

How to set financial goals in 5 steps

Setting and working toward financial goals becomes easier when you reflect on your intentions.

How to maintain your lifestyle in retirement

Seven strategies that can help you work toward the retirement you want.