Want retirement help or a second opinion on your plan?

Connect with a wealth specialist for a free no-obligation consultation.

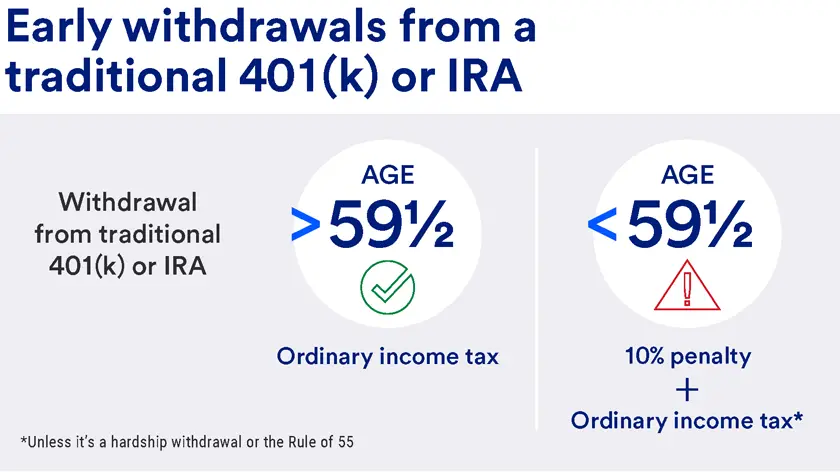

If you withdraw from an IRA or 401(k) before age 59½, you’ll be subject to an early withdrawal penalty of 10% and taxed at ordinary income tax rates.

There are several scenarios, known as hardship withdrawals, where you can avoid the 10% penalty. These include using the money for medical expenses, higher education expenses and a first-time home purchase.

If you have to withdraw money from your account, another option to avoid the penalty is to take out a 401(k) loan. Although the loan must be repaid within five years, you keep the tax benefits and your retirement plan on track.

To encourage retirement saving, the federal government offers special tax breaks for contributing to a qualified retirement plan like an individual retirement account (IRA) or 401(k).

But there’s a tradeoff: If you make a 401(k) withdrawal or IRA withdrawal before you retire, you may have to pay an early withdrawal penalty on top of the ordinary income taxes that will be due upon withdrawal.

Read on to learn more about 401(k) withdrawal rules and traditional IRA withdrawal rules.

IRAs and 401(k)s are qualified retirement accounts, which means they receive favorable tax treatment. With traditional IRAs and 401(k)s, pre-tax money grows tax-deferred until you withdraw it in retirement, at which time you pay income taxes at ordinary income tax rates.

Roth IRA withdrawal rules differ from a traditional IRA because your money grows tax-free and you can withdraw it tax-free in retirement. The same withdrawal rules apply to Roth 401(k)s.

Withdrawing money from a retirement account early and paying penalties and taxes should be done only after you’ve exhausted every other option, since doing so may have a negative impact on your long-term retirement finances.

For the purposes of 401(k) withdrawals or traditional IRA withdrawals, retirement is considered to be age 59½. If you withdraw from a traditional IRA or 401(k) before this age, those withdrawals are subject to a 10% early withdrawal penalty and taxation at ordinary income tax rates.

Roth withdrawal rules are different. Early withdrawals of Roth IRA or Roth 401(k) contributions are not subject to a 10% penalty, since they were made on an after-tax basis. However, withdrawals of earnings from Roth accounts made before age 59½ and before the account is five years old may be subject to taxes and a 10% penalty.

Note that you must begin taking distributions from traditional IRAs and, in some instances, 401(k)s when you reach age 73. These are referred to as required minimum distributions, or RMDs.

There are some scenarios in which you could make an early 401(k) withdrawal or IRA withdrawal without paying the 10% penalty. These are known as hardship withdrawals. For 401(k)s, check with your employer about which hardship withdrawals apply to your plan and how to get approved. You may be required to verify that you don’t have any other available financial resources to satisfy your financial need.

See the IRS list of early distribution tax exceptions.

When facing financial emergencies or cash flow shortfalls, it can be tempting to withdraw from a qualified retirement plan. However, withdrawing money from a retirement account early and paying penalties and taxes should be done only after you’ve exhausted every other option, since doing so may have a negative impact on your long-term retirement finances.

If you really need to use the money in your retirement account before you’re 59½ and you don’t meet the qualifications for a hardship withdrawal, consider taking out a 401(k) loan instead of taking an early withdrawal.

Many 401(k) plans allow participants to borrow their own money and repay the loan with interest via automatic payroll deductions. You’ll avoid the early withdrawal penalty, retain the tax benefits and keep your retirement plan on track. However, if you leave your job either voluntarily or involuntarily, the loan will become immediately payable (you usually have until your tax filing deadline) or it’s treated as a distribution and is subject to income tax and the 10% early withdrawal penalties.

401(k) loans usually must be fully repaid within five years unless the money is used to purchase a primary residence. The maximum 401(k) loan amount is $50,000 or 50% of the account’s vested value. Not all 401(k) plans permit loans, so ask your plan administrator or review the 401(k) Summary Plan Description to learn more about your plan’s loan provisions.

Another unique early withdrawal circumstance is known as the Rule of 55. This allows you to withdraw money from your 401(k) penalty-free if you leave your job or are laid off during the year in which you turn 55, or later. Income tax would still be assessed on the money you withdraw, but the 10% early withdrawal penalty would be waived.

The Rule of 55 only applies to the 401(k) plan at your most recent employer and can be a useful tool if you want to retire between the ages of 55 and 59½. Not all 401(k) plans allow for early withdrawals under the Rule of 55, so be sure to check your plan’s Summary Plan Description.

It’s critical to understand the rules governing withdrawals from qualified retirement accounts. Otherwise, you could make costly mistakes that jeopardize your retirement financial security. Learn how our approach to financial planning can help you review financial opportunities from all perspectives.

Unlike a traditional IRA, a Roth IRA allows you to contribute after-tax dollars now and withdraw contributions tax-free in retirement. Get details on Roth IRA contribution limits, Roth IRA income limits and Roth conversions.

Whether you prefer investing on your own or want professional guidance, we have an option to fit your needs.