Capitalize on today's evolving market dynamics.

With changes to taxes and interest rates, it's a good time to meet with a wealth advisor.

Tax loss harvesting is when you sell securities for less than their cost basis to offset realized capital gains in other areas.

Tax loss harvesting can be used in many situations, including when rebalancing your portfolio and trying to stay in a lower tax bracket.

Tax loss harvesting is a complex strategy, so getting advice from a financial professional is important.

Buy low and sell high. It’s considered the universal strategy for investing. But what happens when a portion of your portfolio is in the red? Tax loss harvesting could be an effective way to manage those investment losses while potentially reducing your tax liability.

Tax loss harvesting could be useful for investors with realized gains who prefer not to maintain specific positions, need increased liquidity, or want to capture gains while planning to reinvest at an appropriate time.

Tax loss harvesting is when you sell securities for less than their cost basis, or the price you originally paid for them. This captures losses to offset gains you may have realized in other investments.

Tax loss harvesting involves selling securities at a price lower than their cost basis (the purchase price). This process helps you capture losses to offset gains realized from other investments, such as real estate, businesses, or other significant assets.

The way losses are matched to gains depends on the period for which the assets were held. Typically:

If there are more losses than gains, short-term losses can be used to offset long-term gains and vice versa. Further, amounts beyond the matched gains can be applied to offset up to $3,000 of your ordinary taxable income ($1,500 for those married filing separately). Any remaining losses can be carried forward to subsequent tax years.

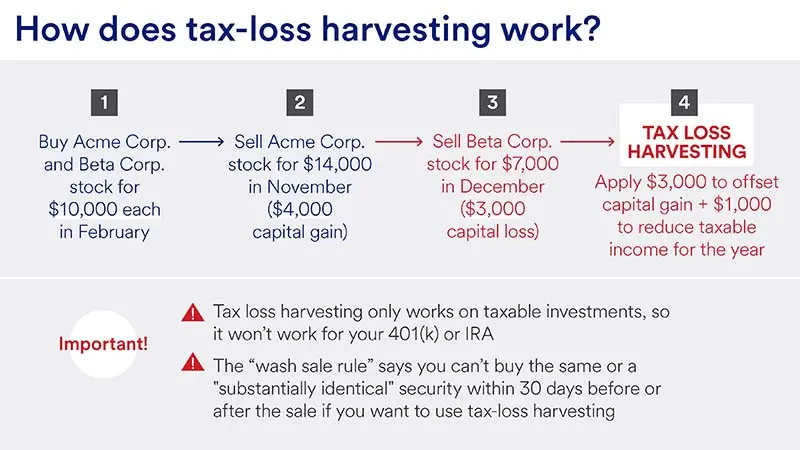

Consider this scenario:

You own shares of Acme Corp. and Beta Corp., both held for less than 12 months. Selling Acme Corp. stock at a profit would make it subject to short-term capital gains tax (typically higher than long-term capital gains tax). You could sell Beta Corp. stock for less than its purchase price to offset some of that tax liability. The short-term capital loss from Beta Corp. can first offset the short-term capital gain from Acme Corp.; any excess may be applied to regular taxable income or carried forward for future tax use.

However, note that if you repurchase the same stock within 30 days of sale, the “wash sale rule” prevents you from claiming those losses. Instead, the loss gets added to the newly acquired stock’s cost basis.

Tax loss harvesting can provide potential benefits depending on your financial scenario. Here are some situations where tax loss harvesting might be useful.

Rebalancing during an up market often results in capital gains. Tax loss harvesting can help offset gains by selling positions with losses, minimizing the tax impact of the rebalance.

During down markets, traditional IRA or 401(k) conversions to Roth accounts can result in lower taxable ordinary income. Tax loss harvesting can further reduce this burden, especially benefiting young investors with a long time horizon for growth.

Strategically taking losses can reduce your adjusted gross income (AGI), helping you remain in a lower tax bracket. This reduction might also allow eligibility for Roth IRA contributions or other deductions.

For high-net-worth individuals, tax loss harvesting is a crucial tool for handling gains across diverse assets, such as investments, businesses, and properties. Leveraging losses to offset gains can maintain financial efficiency.

For those approaching retirement with significant company stock in their portfolio, tax loss harvesting combined with net unrealized appreciation (NUA) planning can be an effective strategy to reduce taxes. For instance, selling off these positions while identifying other assets with recorded losses can ensure a balanced approach for tax savings.

While tax loss harvesting can be done at any time, most investors choose to use this strategy near the end of the year, once they have a better idea of their portfolio performance and start planning to file their taxes. Starting in October or November is recommended to avoid the rush during December’s tight deadlines.

Tax loss harvesting holds the potential for meaningful financial benefits but involves nuanced and complex processes. Consulting qualified financial and tax professionals is crucial to determine the strategy’s suitability for your unique financial situation.

Learn about our approach to investment management and how we can support your financial goals.

Capital gains tax kicks in when you sell a capital asset and realize a profit. A financial professional can help you design a tax strategy that minimizes your capital gains tax exposure.

Let us help you craft a portfolio that reflects your goals, time-horizon and values.