A mortgage is a type of loan that is used to buy or refinance a home or property. There are many types of mortgage loans, but it's easy to understand their unique features and benefits with a useful mortgage comparison. Knowing the differences between the types of mortgages can help you prepare to apply for a mortgage loan when you find a home or property you love.

From purchasing your first home to financing an investment property, we’ve got you covered.

We offer loans that meet almost every mortgage need.

Conventional fixed-rate loans

No interest rate changes

FHA loans

Lower credit score requirements

VA loans

Option to make $0 down payments for military members

The rates shown are current as of $date.

These rates are based on some standard assumptions as described below.1 Learn more about interest rates and annual percentage rates (APRs).2 Plus, see an estimated conforming fixed-rate monthly payment and APR example.3

Compare all mortgage loan options in one easy spot.

Focus your home search by understanding what you can afford.

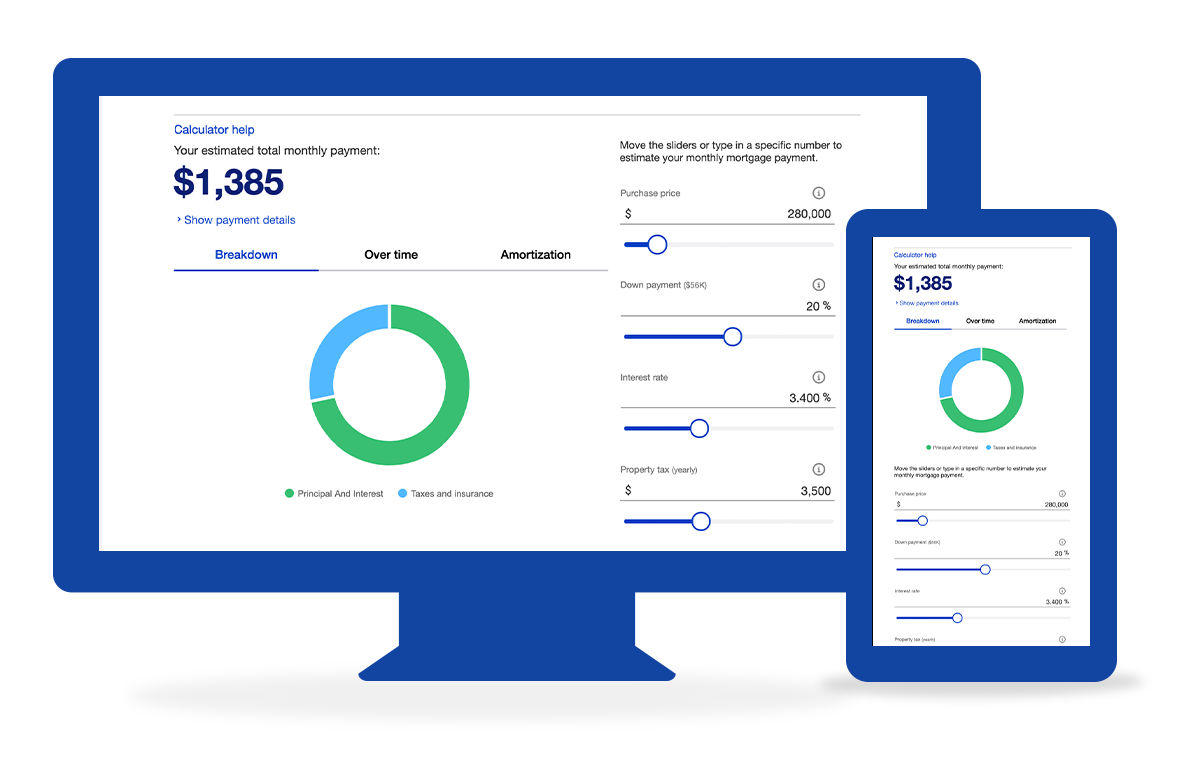

Crunch your numbers and estimate your monthly payment.

Get real insights about the first-time home-buying experience.

Buying a home can be one of the most exciting — and stressful — moments of your life. But finding a home you can call your own makes it all worthwhile. Watch a video of one couple’s first-time home buyer experience or explore our first-time home buyer guide for tools and resources designed to help eliminate the stress of buying a house, so you can move forward with confidence.

Explore articles designed to help you along your home-buying journey.

The mortgage loan process

How much house can I afford?

How does my credit score affect my mortgage rate?

FAQ

Mortgage loans are offered by lenders to qualifying borrowers. A borrower pays back the mortgage over an agreed length of time called a “term”.

Lenders will typically loan mortgages to borrowers based on a variety of qualifying factors that can include credit score, debt to income ratio and credit history. You can strengthen your ability to qualify for a mortgage by monitoring your credit score and take steps to get your score as high as possible prior to applying for a mortgage.

A great way to start your home-buying journey is to get an early estimate of how much you might be able to afford. Use affordability calculators that give estimates on your monthly payments or get an idea of how much you might be able to borrow with a prequalification.