You may already have insurance coverage for your day-to-day needs: health, auto and property. But those aren’t the only types of insurance you might need during your lifetime.

As your needs and the needs of your loved ones change, you don’t want to ignore three types of personal insurance: disability, life and long-term care.

Not only can these three protect your family from unforeseen circumstances, but they also can play a significant role in smart financial planning for your later years, conserving your retirement nest egg.

Here are a few key details you should know about each.

1. Disability insurance for when you're unable to work

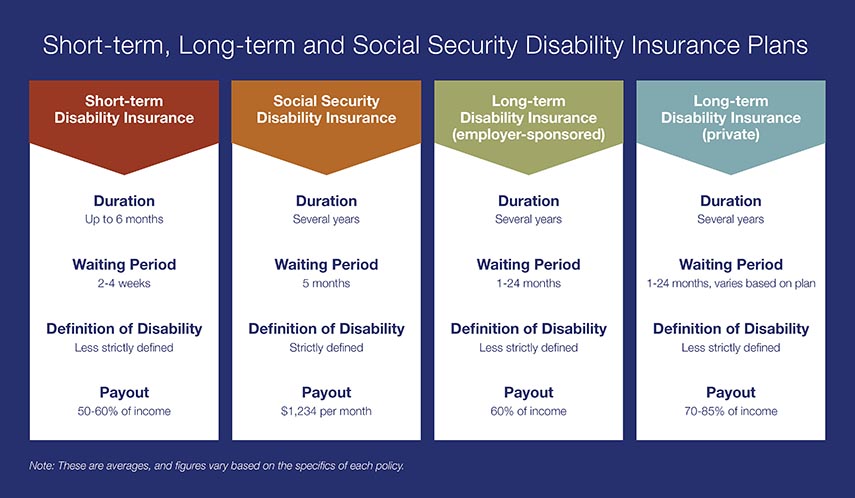

Some people may assume that the government will provide disability insurance, but federal and state plans are particularly strict in their definitions of disability. In fact, the Social Security Administration rejects nearly two-thirds of all applications for Social Security disability benefits.1

Are you prepared for an unexpected injury or illness that could compromise your ability to work? That's where private disability insurance comes in.

Private disability insurance, whether through an employer or purchased individually, offers a more lenient definition for qualifying: You simply must be unable to perform your occupation or an occupation that matches your training, education and experience.2 Choosing private coverage can act as an important safeguard should you be unable to work for an extended period of time.

There are two types to consider: short- and long-term. Short-term disability typically provides three to six months of coverage and extends benefits almost immediately. Long-term disability can provide years of coverage, but you'll have to wait longer to begin receiving benefits. Long-term disability insurance replaces a portion of your paycheck — typically around 60% — to help you meet your daily expenses and recurring payments, including your mortgage.2

Learn more about individual long-term disability insurance.

2. Life insurance for helping your loved ones

Life insurance is commonly known, but it can cause confusion because of the many options and your reasons for purchasing it. In its basic definition, life insurance provides a lump-sum payment to your beneficiaries when you die. This can help protect your loved ones should you leave behind a sizable loss of income, unresolved debt or other financial responsibilities.

There are two main types of life insurance and each offers specific advantages.

- Term life insurance: Term life insurance covers you during a set period of time (10-30 years) and is usually the most affordable option, but only in the short-term. When your policy term ends, premiums can rise substantially.

- Permanent life insurance: Permanent life insurance policies are significantly more expensive than term life policies because they’re designed to last your entire life. The three primary forms of permanent life insurance are whole life, universal life and variable life. All three types of policies can include a cash value component that grows on a tax-deferred basis and can increase in value over time.

Read more about the difference between term and permanent life insurance and what to consider as you review your options.

3. Long-term care insurance for aid in your later years

Even with substantial retirement savings and emergency funds, costs for long-term care can be overwhelming. In general, health insurance only pays for doctor and hospital bills, and Medicare will only pay for care at home under very limited circumstances.

Long-term care insurance can fill a financial gap by covering a portion of healthcare and related expenses. Some permanent life insurance policies even offer a long-term care component, which is an efficient way to address several financial planning goals through one policy.

There are also stand-alone policies that cover nursing homes, hospice services, assisted-living and at-home care for a set number of years. Premiums vary based on a number of factors, including age, general health and the exact type of coverage.

Read 7 things to know about long-term care insurance.

Safeguarding against the unforeseen

Life is unpredictable, but you can better prepare for it by opting for disability, life and long-term care coverage that will protect you when you or your loved ones need it.

Learn about life, disability, and long-term care insurance through U.S. Bancorp Investments.