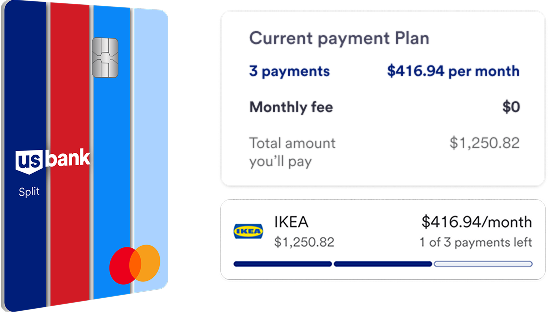

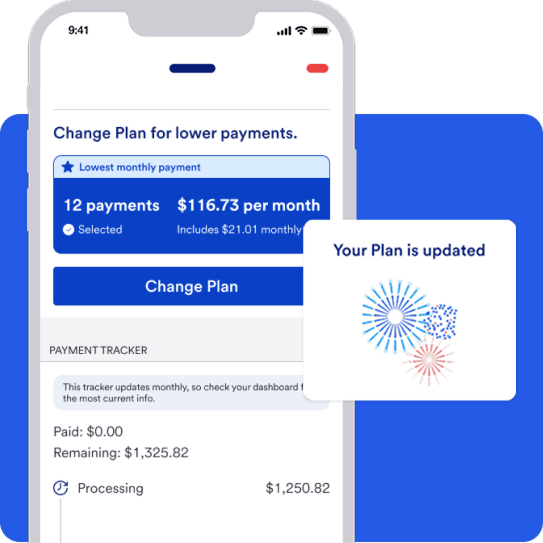

Purchases of $100 or more will automatically be divided into 3 payments and placed into a Plan to be paid back over 3 months, with no Plan Fees. Prior to the end of the billing cycle in which a Plan has been set up, you may log into online banking (usbank.com) or the U.S. Bank Mobile App, to extend the repayment period to 6 or 12 months for a small monthly Plan Fee (see full terms and conditions).1,2 U.S. Bank cannot control when merchants submit purchases to post to your account or the amount of those purchases. If a purchase posts on the same day as your billing cycle, you will not be eligible to select a plan duration of 6 or more months. The purchase will automatically be divided into three payments and placed into a 3-month payment plan.

The duration of the Small Purchase Plans may not be extended.