Insights based on experience

The U.S. Bank Asset Management Group (AMG) helps guide U.S. Bank economy and policy analysis, while closely monitoring U.S. and global capital markets to help inform your wealth management professional’s approach to your investments.

The AMG team has more than 200 seasoned professionals with expertise in traditional asset classes like stocks and bonds as well as alternative investments such as hedge funds and private capital, and a deep understanding of the macroeconomic environment. The team also focuses on capital market research that’s complemented by a rigorous due diligence approach.

Putting expertise into action

When designing your customized portfolio, your wealth professional will leverage AMG’s expertise.

AMG's models are objective and based on the team's awareness of market dynamics, historical insights, asset allocation and investment options, supported by research and due diligence. This analytic, fact-based approach is the foundation for our organization’s investment offerings and guidance.

Market analysis

Investment thought leadership from AMG experts can help you stay informed and invest with confidence, whether markets are stable or uncertain. Go to Market News for webinars, client calls, videos and other timely insights and commentary.

The AMG leadership team

The AMG leadership team includes industry experts who help inform our organization's investment approach and methodology. AMG leaders are frequent spokespeople for U.S. Bank and routinely appear on CNBC, Bloomberg, Fox Business and Yahoo! Finance.

Kaush Amin, CFA

Due Diligence Strategy Director

Kaush and his team are responsible for the private capital investments program, providing key strategic leadership in our alternatives practice.

Natalie J. Burke

Co-Head of Public Markets Due Diligence

Natalie co-leads a team responsible for conducting investment due diligence and manager selection for active, passive and hedge fund strategies within public equities, fixed income and real estate assets.

Chad Burlingame, CFA, CAIA

Co-Head of Public Markets Due Diligence

Chad co-leads a team responsible for conducting investment due diligence and manager selection for active, passive and hedge fund strategies within public equities, fixed income and real estate assets.

Thomas M. Hainlin, CFA

National Investment Strategist

Tom co-leads investment strategy, portfolio construction and investor content development across asset classes and capital market events.

Robert L. Haworth, CFA

Senior Investment Strategy Director

Rob co-leads investment strategy, portfolio construction and investor content development across asset classes and capital market events.

William J. Merz, CFA

Head of Capital Markets Research

Bill and his team are responsible for quantitative modeling and analysis focusing on the global capital markets investment set.

William T. Northey, CFA

Investment Director

Bill oversees client-facing teams leading asset and portfolio management for our wealth management business, which consists both of high net worth and institutional clients.

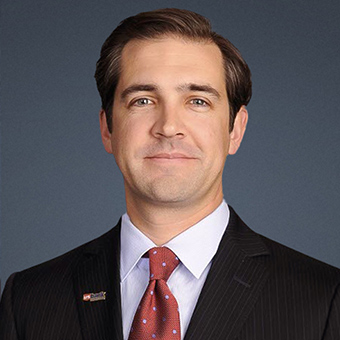

Terry D. Sandven

Chief Equity Strategist

Terry and his team manage core equity and dividend growth portfolios for individuals, families and institutions.

Explore our news and insights

Market news

Read our up-to-date reports on economic events and news from the markets.

Investing insights

Discover trends and ideas that may impact your investing strategy moving forward.

How to determine your risk profile

Your investment time horizon and emotional response to market volatility are key factors in helping you assess your risk tolerance.