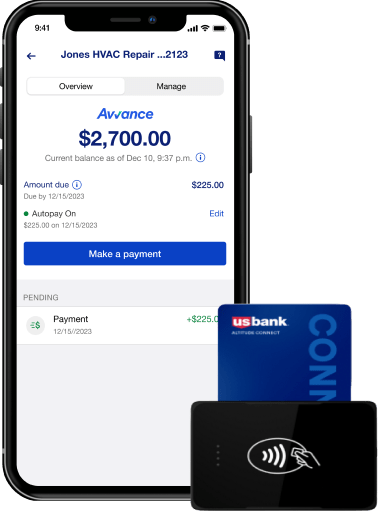

On-the-go or mobile point-of-sale (POS) systems for include specialized software and equipment that helps streamline operations, manage payments, analyze sales and more.

Key features of U.S. Bank’s on-the-go POS systems:

- Order processing and management

- Menu management

- Payment processing

- Inventory management

- Basic customer tracking

- Reporting and analytics

- Card reader hardware