U.S. Bank Avvance launches customized embedded financing offering

Partner financial institutions can now tailor Avvance to their business needs with new developer portal.

NEWS

November 5, 2025

Split Card automatically converts purchases into plans with equal monthly payments, no interest or annual fee

U.S. Bank today announced a new kind of credit card that enables automatic no-fee, no interest equal monthly payments on all purchases: the U.S. Bank Split™ World Mastercard®.

Split Card introduces a new alternative to traditional Buy Now, Pay Later options – a single solution to manage multiple pay-over-time plans that is backed by a major bank, providing valuable consumer protections and the ability to build credit.

The Split Card can be used to shop in-store or online everywhere Mastercard is accepted, and every purchase is automatically split into a three-month payment plan with no interest or annual fee. Cardholders can also choose to extend payment plans to six or 12 months for larger purchases for a small, fixed monthly plan fee.

“Split Card meets the diverse needs of today’s consumers who are seeking easy and transparent ways to fund purchases of all sizes,” said Chris Roncari, head of product and experience for consumer and small business payments at U.S. Bank. “Split Card has elements of a typical card but is far from a typical credit card with its budgeting control and interest-free option. We expect Split Card will be a top choice for Gen Z consumers, and many others, who desire the broad scale usability, simplicity, and protections of a credit card but also need the financial consistency of equal monthly payments.”

Here’s how the Split Card works:

Split Card is the latest U.S. Bank product to provide installment plan repayment options. In 2021, U.S. Bank ExtendPay® launched, providing consumer and business cardholders the ability to move eligible transactions to equal monthly payments. With Split Card, all purchases are automatically split into three equal monthly payments with no interest and no fees, eliminating any extra steps after each purchase.

To learn more, visit usbank.com/splitcard.

Disclosures: Loans and lines of credit are offered by U.S. Bank National Association. The creditor and issuer of the U.S. Bank Split™ World Mastercard® is U.S. Bank National Association, pursuant to a license from Mastercard International Incorporated, and the card is available to United States residents only. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

More payments news

Partner financial institutions can now tailor Avvance to their business needs with new developer portal.

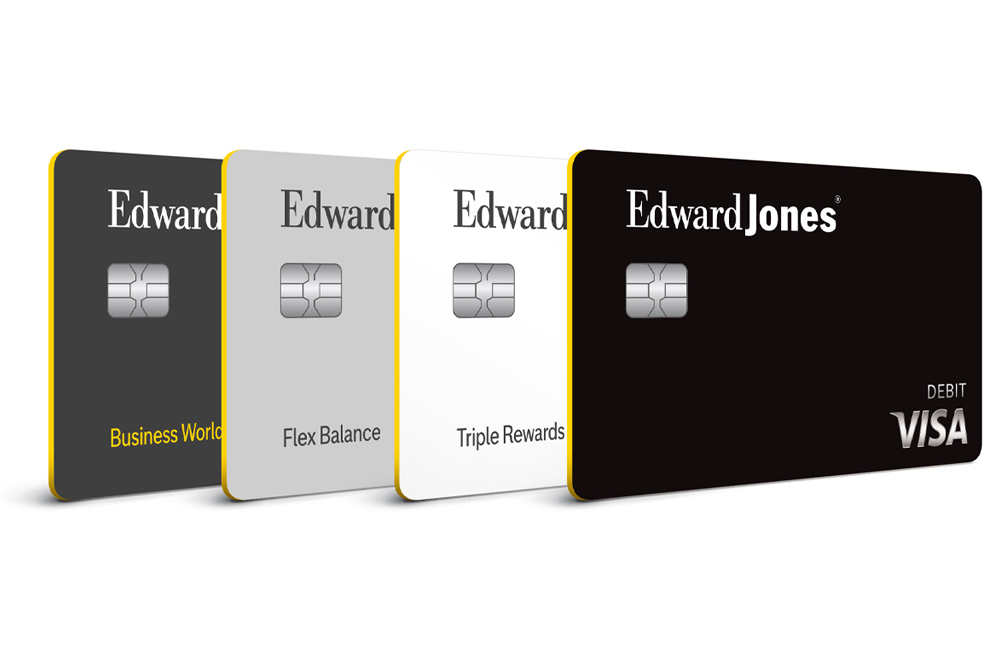

The alliance brings U.S. Bank deposit and credit card products to Edward Jones clients.