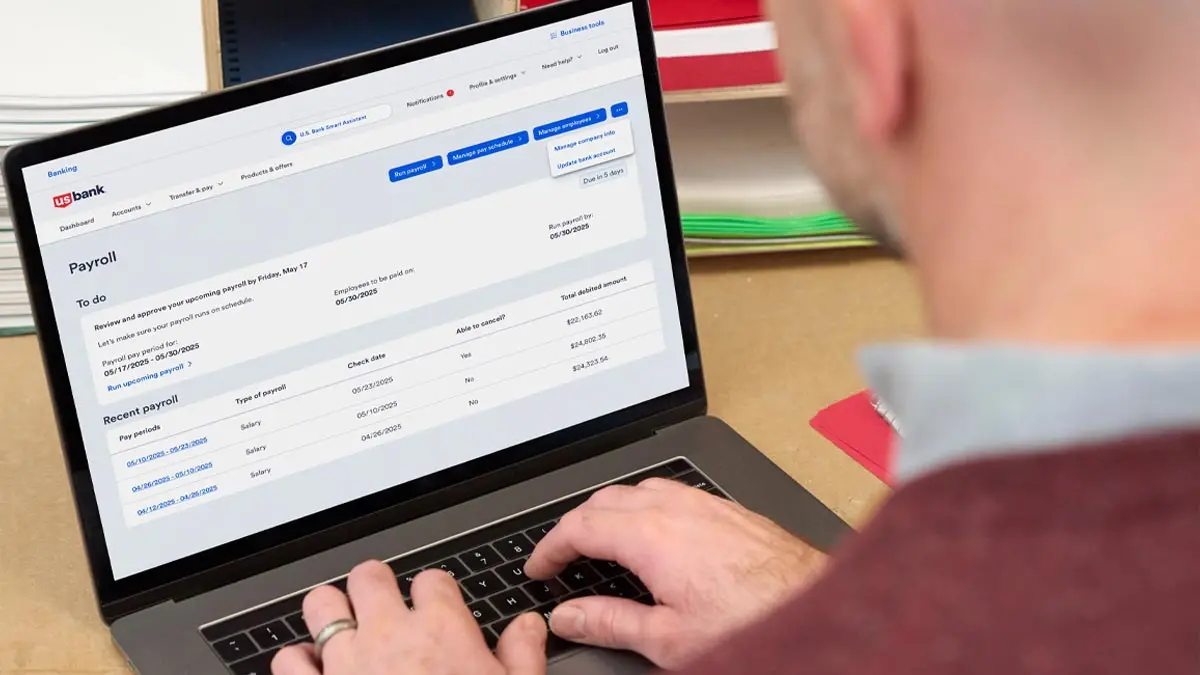

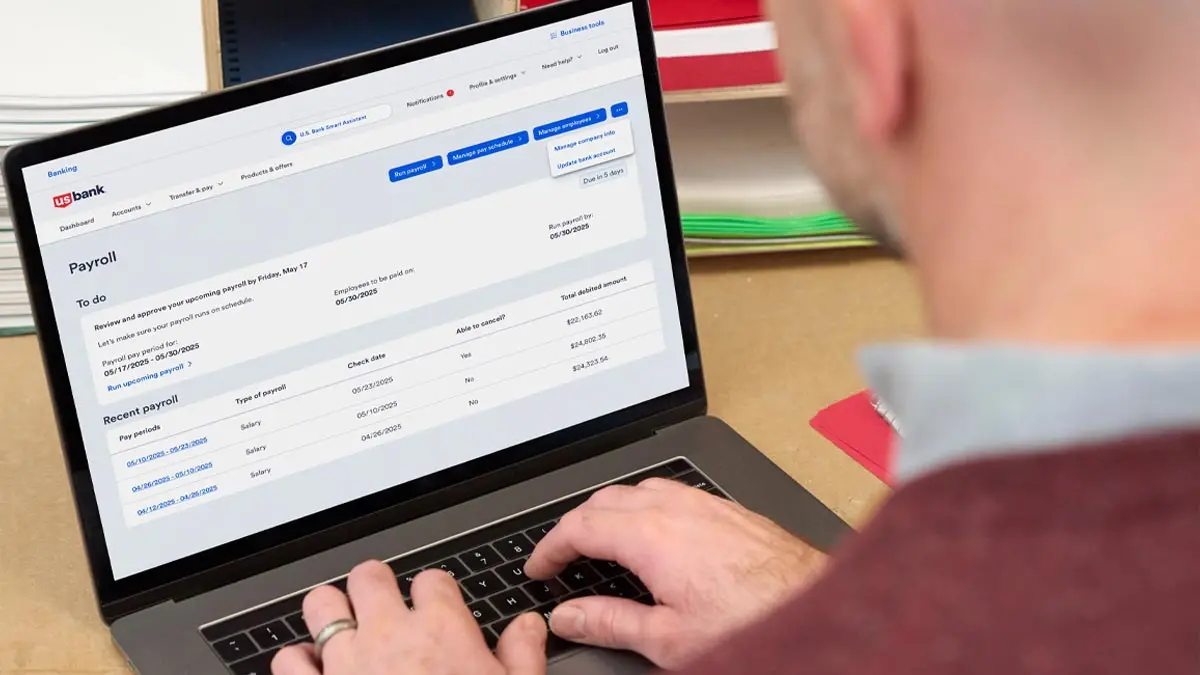

U.S Bank launches new embedded payroll solution for small businesses

All-in-one solution provides single view across banking, payments and payroll

NEWS

September 24, 2025

Seamless transition between audit executives to begin this month

MINNEAPOLIS – U.S. Bancorp (NYSE: USB), parent company of U.S. Bank, announced today that Senior Executive Vice President and Chief Audit Executive Kandace Heck plans to retire from the company later this year and will be succeeded by Christopher Paulison.

“For the past eight years, Kandace has been an important voice at U.S. Bank, leading our Corporate Audit Services function and working to strengthen our internal audit capabilities. She brought credible challenge in a time of tremendous change. We wish her well as she plans to retire from the company,” said Gunjan Kedia, U.S. Bancorp CEO. “We also are delighted to welcome Chris. Among the things that most impressed the Board about him were his wide-ranging and deep experience in the financial services industry and his perspective on how we could improve capabilities and operations to support a strong, stable company that clients and shareholders will embrace for years to come. We are confident his leadership will be an excellent complement to our existing executive team.”

Heck joined U.S. Bank as chief audit executive in April 2017, after building a meaningful career in audit and accounting with companies like Northern Trust Corporation, Goldman Sachs and Deloitte & Touche. All told, she spent more than 30 years in the industry, working both in the United States and overseas. She has been a strong community partner involved in theater, public libraries, public media and organizations committed to improving the workplace.

Given the independent nature of the company’s Corporate Audit Services function, the Audit Committee of the U.S. Bancorp Board of Directors oversaw the process for the appointment of the chief audit executive. Paulison was hired with an eye toward continuing to build on a strong audit foundation, ensuring a robust organization is in place to support ongoing growth and lasting shareholder value.

Paulison joins U.S. Bank on Sept. 29 with more than 30 years of audit experience in large corporate settings and management consulting firms. Most recently, he was a managing director of financial services at Protiviti Inc., where he led the internal audit engagement teams for top-tier financial institutions based in New York and London. His impressive career has afforded him leadership responsibility and exposure to our industry through roles at well-established firms such as Grant Thornton and Ernst & Young, and he is well-versed in the rigors and demands financial services firms face. An alumnus of the University of Notre Dame and Northwestern University’s Kellogg School of Management, he will be based in Minneapolis and report directly to the Audit Committee, as well as administratively to Kedia.

###

About U.S. Bank

U.S. Bancorp, with approximately 70,000 employees and $686 billion in assets as of June, 2025, is the parent company of U.S. Bank National Association. Headquartered in Minneapolis, the company serves millions of customers locally, nationally and globally through a diversified mix of businesses including consumer banking, business banking, commercial banking, institutional banking, payments and wealth management. U.S. Bancorp has been recognized for its approach to digital innovation, community partnerships and customer service, including being named one of the 2025 World’s Most Ethical Companies and one of Fortune’s most admired superregional banks. Learn more at usbank.com/about.

Contacts

Investors:

George Andersen, director of investor relations, U.S. Bancorp Investor Relations

george.andersen@usbank.com

Media:

Jeff Shelman, senior vice president and head of external enterprise communications, U.S. Bank Public Affairs and Communications

jeffrey.shelman@usbank.com

More company news

All-in-one solution provides single view across banking, payments and payroll

Offering expanded to include bitcoin ETFs