Financial guidance and support, tailored for you.

Explore the benefits of personalized wealth services.

A legacy letter is a way for you to share your wishes, dreams and motivations to your beneficiaries.

It’s not a legally binding document; rather, it’s a companion to your will and estate plan.

It can help prevent discord among your beneficiaries by explaining why you distributed your assets in the way you did.

Wills and estate plans are necessary tools for distributing your assets after you pass away. As legal documents, they help carry out your final wishes by detailing your assets and the beneficiaries of those assets.

What wills and estate plans don’t do, however, is communicate the “why” behind your choices. To share the stories and dreams behind the dollars and cents, you need to write a financial legacy letter.

A legacy letter is a tool that explains your values, traditions, beliefs and wisdom to future generations. Also called an ethical will or legacy statement, it’s a chance to convey your personal journey, including how you created your wealth. A legacy letter also lets you explain why you want your assets to be used in a certain way.

Before you start creating your legacy letter, it’s essential to know that it only serves as a guideline for your heirs and their advisors. It is not a legally binding document. The details of your wealth transfer plan, along with any nonnegotiable instructions for its use, must be included in your estate documents.

There are no rules for writing a financial legacy letter; it can include anything you wish. What’s important to remember is that your letter should be thoughtfully written and include what matters most to you. Take time to reflect. A legacy letter can be a document you write and rewrite.

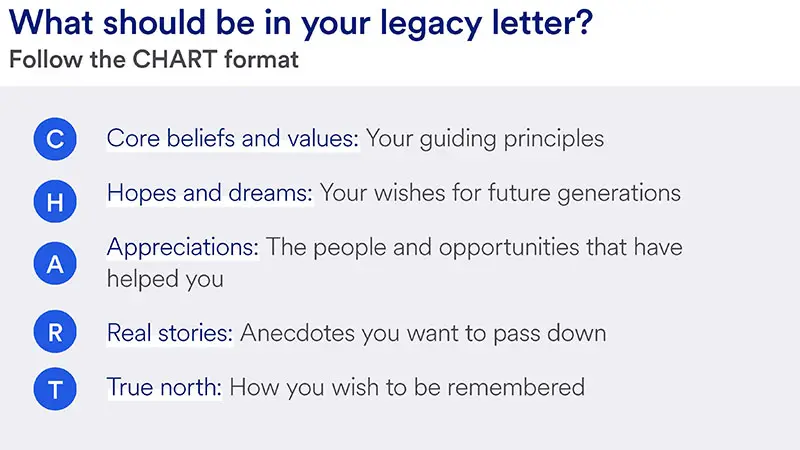

A good blueprint for a legacy letter is to follow the CHART format, which stands for:

First, define your core beliefs and values. These are the commitments and guiding principles that have carried you through life. For example, recount a challenge you faced and an important choice you made that changed the trajectory of your life. Or describe a difficult time you experienced and how you overcame the struggle.

Next, identify your hopes and dreams. These are the end goals to which your beliefs and values point. Here, convey your wishes for future generations—anyone who may benefit from your estate. Also, share your dreams and passions, helping your heirs get to know you better.

A legacy letter is an excellent place to show appreciation for the people, places and opportunities that helped you along the way. Someone may have given you a chance when no one else would. Or perhaps a particular person took you under their wing and changed your life for the better. It’s a way to show gratitude to those who came before you and the sacrifices they made to help build your family.

Your letter can also chronicle real stories, the anecdotes you want to make sure your heirs know and remember. These are often family tales that are told and retold at the dinner table. Stories help younger generations understand your intentions by bringing your beliefs and values to life. They also create a sense of legacy.

Finally, think of your true north. This represents who you are at your deepest level. This is how you wish to be remembered. Sharing your true north can help your heirs find and follow their own.

Following the CHART format is only one example blueprint for legacy letters. You can personalize your letter by choosing its form. Traditionally a written document, a legacy letter can also be recorded as a video or audio file. The key is to select a vehicle that makes you the most comfortable and will be accessible to you and your heirs in the future.

While anyone can write a financial legacy letter, it has the potential to play a critical legacy-planning role in families with significant wealth. Pairing a legacy letter with a will or trust can help your heirs make the best use of the assets they'll receive one day, increasing the likelihood that they’ll follow your wishes.

Legacy letters are also great tools for explaining the decisions you make when planning your estate. Delivered from you directly, this information provides context that a will or trust does not. It could help prevent misunderstandings or discord between those who will receive and benefit from your money.

A legacy letter is distributed to whomever you choose. This often includes your children and any other heirs named in your estate plan. You can also have your letter distributed to future generations. Your words can convey a lasting record of your emotions and values, helping beneficiaries feel connected to you after you’re gone.

If you are gifting money to an organization, such as a charity or your alma mater, a legacy letter is an excellent way to convey your appreciation for its existence. You can also share how you wish your gift to be used.

Legacy letters can be distributed after your death with your estate plan. You can also instruct letters to be given at certain life milestones, such as before a child's wedding, graduation or birth. Better yet, you can distribute the letter while you're still alive to start conversations or answer questions.

Building and maintaining your financial legacy of wealth often takes teamwork. Learn how U.S. Bank wealth advisors and teams can help you build your family legacy.

Families with significant wealth should have a comprehensive strategy for intergenerational wealth transfer. A key part of that is building family capital, which involves educating family members and ensuring they’re aligned on its wealth preservation philosophy.

Explore the benefits of personalized wealth services.