A K-shaped economy describes an economic recovery where different groups or industries experience vastly different outcomes – some thrive and grow while others struggle or decline. This term emphasizes the widening economic inequality during periods of recovery or downturn. In the current recovery, higher-income households have benefited more than lower-income households. This indicates a rising level of income inequality.

Article

The K-shaped economy in 2026: Inequality, technology and the next growth divide

January 7, 2026

Key takeaways

A term first popularized during the COVID-19 pandemic, a K-shaped economy, describes an uneven economy where some segments of the population thrive while others struggle.

The current environment amplifies long-standing inequality, with the greatest gains tilted toward higher-income households, as the share of Americans in the middle class shrinks.

The gap extends to businesses as well, as business revenue for those serving lower-income communities is more vulnerable than for firms focused on wealthier clientele.

What is a K-shaped economy?

A K-shaped economy describes an economic recovery where different groups or industries experience vastly different outcomes – some thrive and grow, while others struggle or decline. This term was intended to highlight the widening economic inequality during periods of recovery or downturn. It fits the saying, “the rich get richer and the poor get poorer.”

This split became increasingly evident after the COVID-19 pandemic. During that period, higher-income households benefited from remote work options, rising asset values in both equity and housing markets (which disproportionately benefits higher income households), and digital adaptation. In contrast, lower-wage workers faced economic headwinds due to historic layoffs, prolonged disruptions, and disproportionate financial pressures, some of which were caused by higher inflation. According to a recent report by the U.S. Bank Economics Research Group, “The K-economy in 2026: Same story, new amplifiers,” this was not a new development, but the continuation of an expanding, long-term inequality trend.

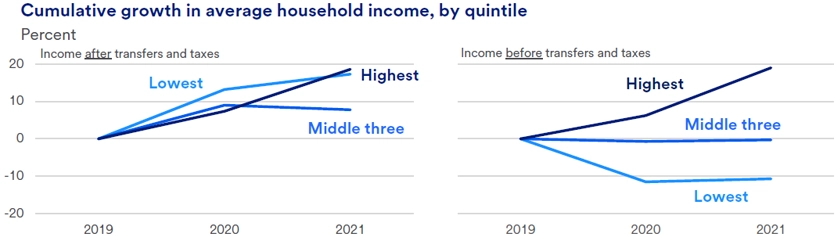

More surprising was the extent to which inequality temporarily contracted at the start of the pandemic. The income gap briefly narrowed during the pandemic’s early stages, largely due to government stimulus payments to households, extended unemployment benefits, and higher wages for specific occupations, such as health care work. These factors reduced income concentration levels last seen in 1990. However, once government programs ended and the economy reopened, the K-shaped trend resumed.

Understanding the ultimate consequences of these developments is complex. Key questions include how rising income inequality might impact the overall economy, how businesses could be affected, and whether technological advances like artificial intelligence (AI) adoption could lessen or worsen the trend. The U.S. Bank report outlines possible ways to change current trends.

Read the Economic Commentary

The K-economy in 2026: Same story, new amplifiers

Resuming the inequality trajectory

The pandemic only briefly interrupted a long-standing trend of increasing inequality. A combination of rising wages, particularly for essential and frontline workers, along with expanded unemployment benefits, stimulus payments, and enhanced tax credits, supported lower-income households. Income growth after transfers and taxes for the lowest quintile (adjusted for inflation) nearly matched that of households in the highest quintile.1

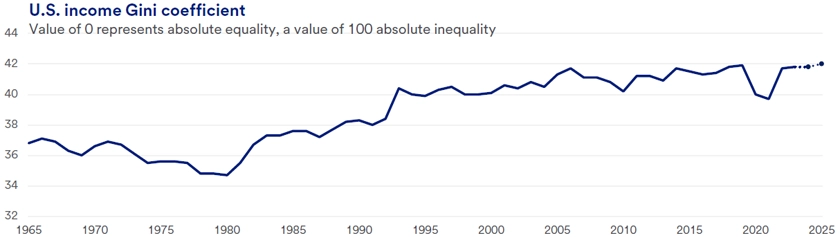

However, these gains were short-lived. As the economy reopened, rising equity markets provided substantial non-wage income to the wealthiest households, while benefits were limited for lower-wage families who own fewer assets. Additionally, pandemic-era programs offering financial support to households were phased out. These and other factors caused income inequality to revert to its previous trend. Currently, income concentration exceeds its pre-pandemic peak and is at levels not seen in 60 years.

Moreover, the number of Americans considered to be middle class shrunk from 61% in 1971 to 51% in 2023, barely a majority, according to a 2024 Pew Research report, with the share of both lower-income and higher-income Americans growing larger. “As financial conditions for American households are further apart,” says Beth Ann Bovino, chief economist, U.S. Bank, “I see no reason to believe that the gap has narrowed since then.”

Today’s K-shaped economy highlights clearer divides between the haves and have-nots. It influences borrowing behaviors, widens generational gaps, and can impact policy discussions. Economic factors such as high interest rates, persistent inflation, and the rapid adoption of transformative technologies, including AI, may deepen these disparities.

As this chart demonstrates, U.S. income inequality trended higher for the better part of a half-century. The numbers indicate levels of inequality, with higher values representing greater income disparity.

“Today, we are returning to a typical pattern of extremely high income inequality, and it now stands at a 60-year peak,” says Bovino. “The worry is not just where we stand now, but also whether ongoing developments will worsen the situation.”

“Today, we are returning to a typical pattern of extremely high income inequality, and it now stands at a 60-year peak.”

Beth Ann Bovino, chief economist, U.S. Bank

Economic concerns of rising inequality

The economic effects of rising inequality are complex. To some extent, it’s a necessary byproduct of a system that incentivizes investment and expansion, which is generally considered a positive trait of a market-driven economy. On the other hand, research indicates that more equality supports sustainable long-term economic growth. Countries with greater equality tend to maintain economic stability longer, while those with higher income concentration often see economic growth spurts fade quickly.2 “A healthy market economy encourages people to spend and invest in themselves and their families,” says Bovino. “But at extreme levels, more and more households are unable to participate unless they rely on debt, which in the end is an unhealthy outcome.”

History shows that excessive income concentration can weaken growth by increasing political polarization and lowering overall demand. According to current research, one trend is for affluent households to save more and consume less, while those with fewer resources depend on borrowing and accumulate debt until it's no longer possible. When these imbalances become unsustainable, the economy typically shifts from boom to bust. The U.S. experienced such a cycle during the Great Recession of 2007-2009.3, 4

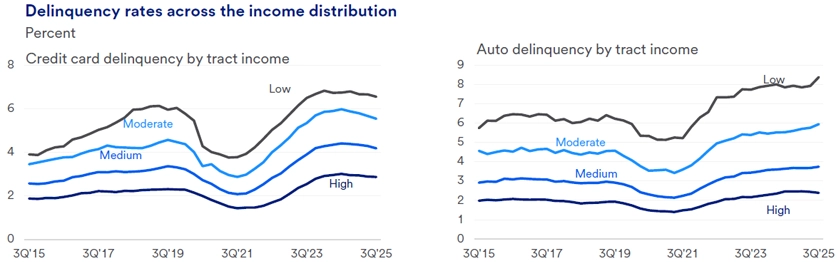

In the current economy, says Bovino, “overall spending has held up despite the divergence between wealthier and lower-income households.” She notes that while higher-income households are maintaining their spending levels, lower-income households are increasingly relying on debt to make purchases. “One concern is that we’re seeing a pickup in delinquency rates among lower-income Americans, particularly in auto loans,” Bovino adds. “This could create risks for ongoing economic growth.”

The potential business impact

If consumer fortunes vary across the income spectrum, businesses might experience different outcomes as well. “In today’s environment, significant spending is associated with very wealthy or moderately wealthy households,” says Bovino. “There’s a clear slowdown in spending among lower-income levels, and that’s starting to affect middle-income households as well.”

She notes inflation as a contributing factor. “The higher prices for products for every dollar spent hurts lower-income households much more than those of higher-income individuals.” In this environment, says Bovino, “we’re increasingly dependent on healthier cohorts to keep the economy afloat.”

What does this mean for businesses? “This polarized consumer base creates significant challenges for firms that depend on mass market demand,” says Schoeppner. “That includes retail chains, hospitality businesses, and companies offering discretionary products or services.” He explains that to remain competitive, these companies may need to rethink pricing strategies, product mixes, and marketing approaches. “The K-shaped economy is also impacting businesses of all sizes, each facing different pressures when it comes to sustaining revenue.”

The impact also varies by geography. A recent report shows that businesses serving higher-income zip codes are doing well, while those in lower-income areas experience slower demand growth and more negative consumer sentiment.5 “This could put a squeeze on specific geographic segments, threatening businesses in lower-income areas,” says Bovino.

While U.S. Bank Economics continues to forecast a soft landing for the U.S. economy, which would represent the first such occurrence since 1995, it puts the risk of a worse outcome at 35%. Stagflation (a combination of slower economic growth with higher living costs) is considered the greatest risk. “This would only worsen living conditions for those on the bottom leg of K, who suffer the most from both the ‘disease,’ which is a combination of higher inflation and job losses; and the ‘cure,’ of higher interest rates,” says Bovino.

Will AI help resolve or aggravate inequality?

AI advancements dominate today’s headlines. These innovations are boosting productivity in capital-intensive sectors, further reinforcing advantages for firms and workers with specialized skills. What does that foretell about technology’s role in influencing the K-shaped economy?

If the benefits of innovation remain concentrated among larger corporations and high-income households, the K-shape will likely become even more pronounced. “Businesses that fail to adopt these technologies risk falling behind in both productivity and profits,” says Schoeppner. “Without broader access to AI and automation tools, income inequality will continue to widen.”

He believes the tide could shift in a different direction. “If technology can be democratized through partnerships, shared platforms, and workforce training, including across small businesses and service sectors,” says Schoeppner, “it could help flatten the inequality curve and even unlock new markets we haven’t yet imagined."

Bovino compares AI’s current impact to 1990s personal computing advancements. “Many administrative roles were replaced as computers and smartphones took over routine tasks. Today, AI-driven job displacement is moving up the ladder, affecting customer service, software development, and programming roles.”

Bovino emphasizes the need for workers to adapt to AI’s growing workplace presence. “We must build AI and digital literacy to enhance skills,” says Bovino. “This benefits employees, employers, and the broader economy.” While progress has been slow, Bovino believes that technological advancements can deliver widespread gains, if both businesses and employees commit to continuous skill development.

The importance of a structural reset

A key question is whether technology will help flatten the K-shaped trend or whether entrenched forces will keep the economy on its familiar path. The answer may shape the next chapter of income inequality and overall economic growth.

Government policy will play a critical role. “We need to consider addressing the needs of those at the lower end of the wealth and income spectrum,” says Bovino. “Government intervention may be necessary, and if it leads to higher wages across income levels and stronger economic growth, it could also boost tax revenues.”

Education is one example. Increasing the average education level of the American workforce by just one year, could significantly benefit workers and potentially boost economic activity by 2.4% within five years.6

Other policy options include targeting the root causes of inequality, such as expanding affordable housing and first-time homebuyer programs. Additional approaches include supporting asset-building initiatives, offering tax credits for younger generations, and revising the tax code with the goal of reducing wealth and income disparities.

Schoeppner notes that the private sector may require a significant shift. “Businesses that fail to adapt risk shrinking margins, inventory challenges, and declining relevance. Companies that embrace value innovation, tech-enabled personalization, and workforce upskilling will be better positioned for success.”

Flattening the K-shaped economy may be crucial for the nation’s long-term economic health. As the saying goes, “a rising tide lifts all boats.” But if smaller boats struggle in the wake of a few large yachts, the economic ship risks capsizing.

FAQ

While rising income inequality may be a necessary byproduct of the nation’s market-driven economic system that incentivizes investment and expansion. On the other hand, research indicates that greater income equality supports more sustainable long-term economic growth. Countries with greater equality tend to maintain economic stability longer, while those with higher income concentration often see economic growth spurts fade quickly.2 “A healthy market economy encourages people to spend and invest in themselves and their families,” says Beth Ann Bovino, chief economist, U.S. Bank. “But at extreme levels, more and more households are unable to participate unless they rely on debt, which in the end is an unhealthy outcome.”

As consumer fortunes vary across the income spectrum, businesses might experience different outcomes as well. “This polarized consumer base creates significant challenges for firms that depend on mass market demand,” says Matt Schoeppner, senior economist, U.S. Bank. “That includes retail chains, hospitality businesses, and companies offering discretionary products or services.” He explains that to remain competitive, these companies may need to rethink pricing strategies, product mixes, and marketing approaches. “The K-shaped economy is also impacting businesses of all sizes, each facing different pressures when it comes to sustaining revenue.”

Tags:

U.S. Bank Economics Research Group

Beth Ann Bovino

Chief Economist

Ana Luisa Araujo

Senior Economist

Matt Schoeppner

Senior Economist

Adam Check

Economist

Andrea Sorensen

Economist

Subscribe to our economic insights newsletter

Not currently a subscriber? Sign up to get our economic insights delivered to your inbox weekly.

Learn more

If you have any questions about any of these topics or want to learn more, please contact us to connect with a U.S. Bank Corporate and Commercial banking expert.