Envision your financial goals.

Picturing how you want to live and what you’d like to accomplish can help drive your financial choices. We’ll discuss your goals and aspirations to help you choose wealth strategies that meet your needs.

Together we’ll clarify your goals to:

- Create wealth. Begin your journey creating wealth through your business, job, inheritance or other ventures.

- Grow your wealth. Pursue potential asset growth with a wealth plan based on your goals and feelings toward risk.

- Protect your wealth. Help protect yourself and your family against the unexpected.

- Make an impact. Direct your assets toward the people and causes that matter most to you.

Create your wealth plan.

When you work with a dedicated financial professional, you’ll have a single point of contact to guide you, backed by a team of specialists. We’ll help you identify and prioritize your goals, and design a plan to work toward them.

We follow four steps in our wealth planning process:

- Engage with you. We identify what’s important to you, including your financial goals and ideal timing.

- Design your plan. With your unique goals in mind we design your wealth plan.

- Implement strategies. Together, we’ll implement strategies to help you work toward your wealth goals.

- Adapt to your needs. We monitor your plan’s performance and make adjustments based on your evolving goals.

Work your wealth plan.

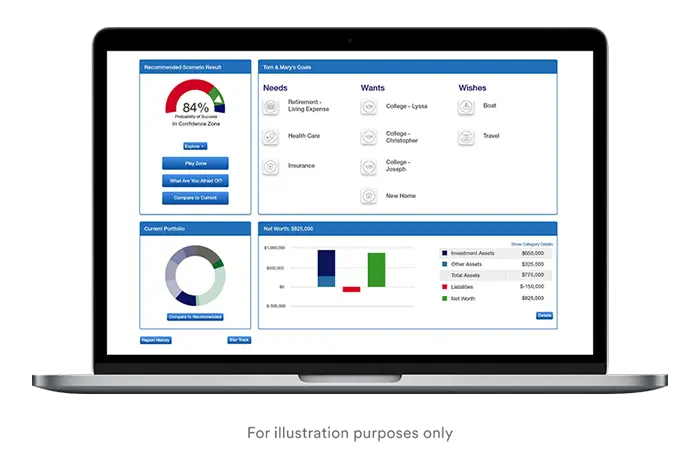

Keeping track of your complete financial picture is easy when it’s viewable in one place. You’ll have secure access to your entire wealth plan, when and how you want it, through usbank.com.

Log in to get a single view of your accounts – even those you hold at other financial institutions – from one convenient dashboard. You can test wealth planning strategies, create what-if scenarios and benefit from other online planning tools.

With all your finances in focus, it’s easy to monitor progress toward your goals and make updates to your wealth plan as your needs evolve.

Build wealth your way

How we can work together

Whether you want personalized guidance or to invest on your own, we have options to meet your needs.

Personalized guidance

Understanding your goals and making sense of your finances is our starting point for your personalized guidance. Wherever you are in your financial journey, we’ll tailor a strategy to help you work toward your financial goals with confidence.

Invest on your own

Trade stocks, bonds, mutual funds, ETFs and more online with U.S. Bancorp Advisors. You will have complete freedom to build and manage your own portfolio using our comprehensive resources and tools.

Explore our news and insights

Market news

Read our up-to-date reports on economic events and news from the markets.

Financial planning insights

Building the life you want starts with a plan. Explore smart financial planning strategies.

How to set financial goals

Setting and working toward financial goals becomes easier when you reflect on your intentions.