Benefits for you and your travelers

You need an efficient corporate travel payment solution that provides your travelers flexibility and convenience – all while helping you reduce costs, streamline processes and gain insight into overall travel spend.

Worldwide acceptance

With millions of locations globally, travelers have easy access to goods, services and cash around the world – eliminating the need for more costly alternatives, like personal cards or cash – while capturing detailed transaction data on every purchase.

Comprehensive travel coverage

Your employees can travel with confidence with comprehensive travel benefits that range from travel accident coverage and auto rental collision to lost luggage reimbursement and travel and emergency assistance.

Flexible spending controls

Customize your program with set spending limits, merchant category code authorizations and other criteria that help keep costs under control. Plus, with built-in liability coverage, your organization is protected from losses due to card misuse.

Greater spend visibility

Better understand who’s spending what and where and use the data for decision making, supplier negotiations, and quickly identify non-adherence to travel and expense policies.

Streamline processes

Embed the U.S. Bank Corporate Travel Card in your expense management and ERP systems. Data-rich transactional information streamlines reconciliations for you and your travelers.

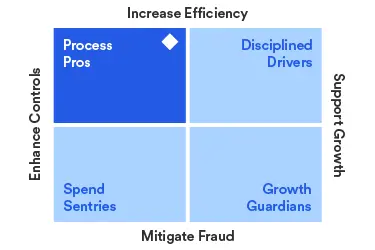

Ready to improve your payables performance?

In just five minutes, get a clear view of how your accounts payable strategy compares to industry benchmarks. Discover ways to streamline processes, reduce risk and support growth.

Making payment for infrequent travelers easier

Capture major travel expenses for those who do not have a corporate travel card, such as infrequent travelers, job applicants or contractors with U.S. Bank Travel Virtual Pay.

Innovative tools that simplify card management and purchasing

Our technology evolves to make corporate card management and use faster, safer and more intuitive.

Access® Online

Easily and securely manage your corporate travel card program with Access Online – a single tool built for admins and cardholders.

Access Online Mobile App

Use the U.S. Bank Access Online Mobile App to check your account, track transactions and make payments from your mobile device.

Mobile payments

Use your mobile device to make secure payments with your U.S. Bank corporate travel card – wherever work takes you.

Rewards that fit your needs

Whether rewards are an expected perk for your employees, a way to increase adherence with company policies or simply a smart financial move for your organization, the optional U.S. Bank FlexPerks® Corporate Rewards program offers some of the richest value in the industry.