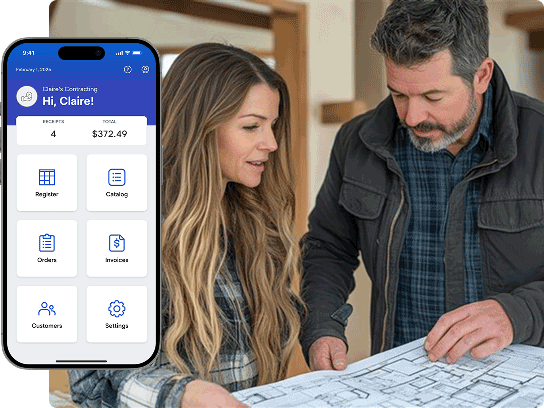

Smart terminal

The smart terminal is a cutting-edge point-of-sale system that allows businesses to accept payments, track sales and more on a handheld device.

Cash management

U.S. Bank's cash management services give you greater control over your finances. Use online & mobile banking, cash flow forecasting, payment add-ons and more.

Business savings accounts

Find the best business savings account for you. Compare U.S. Bank account options and apply online to start maximizing your earnings.

Business checking accounts

U.S. Bank offers various business checking accounts to help manage your cash flow. Discover our account features & benefits. Open an account today.