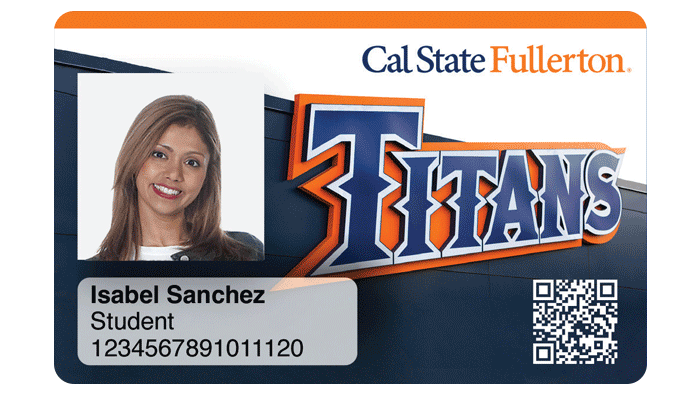

Show your school pride with your co-branded debit card.

Open a U.S. Bank Smartly® Checking account and get a U.S. Bank Visa® Debit Card branded with your university imagery. Use it anywhere Visa is accepted.

Parents, alumni, faculty and other fans can show their spirit, too. Log in to your account to get your card.