Eliminate revenue delays.

Get access to your funds seven days a week so you can pay bills quicker, cover your expenses faster and increase your cash flow efficiency.

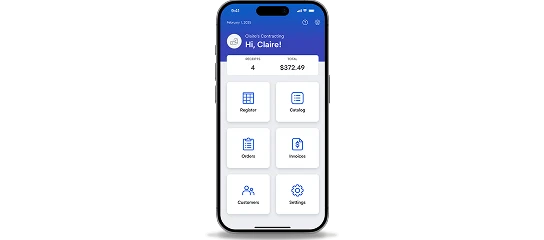

Business Essentials offers features tailored to streamline business banking. It’s a uniquely cost-effective, efficiency-optimizing and card processing solution that helps you keep more of the money you make.

Keep your business safe with fraud-prevention tools.

Automate payables and streamline cash flow directly from your business checking account.

Integrate your third-party accounting, budget management and tax programs for a full view of your finances.

U.S. Bank Payroll powered by Gusto centralizes the tools you need to run payroll, manage tax forms and simplify daily business activities.10

Our hardware options offer convenience and flexibility, and our software makes taking and managing payments a breeze. With competitive pricing and flexible hardware purchase or lease options, our plans ensure you only pay for what you need. Whatever you choose, you’ll receive payments the next day or within 24 hours of payment batch processing. Payments process every day, including weekends.

Enjoy all the benefits of Business Essentials with no monthly maintenance fee.

Many of the most common transactions made by small businesses are included in the free unlimited digital transactions.3

Some transactions, like wire transfers, are unlimited but may have transaction fees associated. For a comprehensive list of account pricing, terms and policies, reference the Business Essentials Pricing Information brochure.

Multiple tasks can be completed during a branch visit and be considered a single teller transaction. For example, multiple checks deposited together using a single deposit slip would count as one transaction. Teller withdrawals are also considered transactions.

Each paper check written on the account is considered a paper transaction.

Each excess transaction costs $0.50.4

Transaction fees starting at:9

Start accepting customer payments at the counter, in the field, at a jobsite or anywhere business takes you – all you need is a smartphone.

Your first mobile card reader is on us! Each additional card reader is $89.

With a built-in card reader, printer and long-lasting battery, you have the power to sell all day without interruption.8

The Platinum Business Checking Package is designed for businesses with high balances and transaction activity. Enjoy additional benefits and earn up to a $1,200 bonus.

Qualifying transactions include: Debit card purchases, ACH and wire credits or debits, Zelle® credits and debits, U.S. Bank mobile check deposit, electronic or paper checks, U.S. Bank bill pay (excluding payments made by credit card) and payment received via U.S. Bank Payment Solutions

Note: You must make all six qualifying transactions within 60 days of opening your account to receive your bonus.

Not eligible: Other transactions such as person-to-person payments, credit card transfers or transfers between U.S. Bank accounts

You’ll receive your bonus 30 days following the last calendar day of the month after you have met the qualifications1.

Business Essentials bonus qualifications:

Deposit at least $5,000 of new money within 30 days.

Maintain at least $5,000 for 60 days after opening the account.

Complete five qualifying transactions within 60 days of opening an account.

Platinum Business Checking bonus qualifications:

Deposit at least $25,000 of new money within 30 days.

Maintain at least $25,000 for 60 days after opening the account.

Complete five qualifying transactions within 60 days of opening an account.

Your bonus will be paid out directly to your new U.S. Bank business checking account.

In order to qualify for the bonus promotion, you must maintain the daily balance promotion requirement. Your account will still be in good standing, but you will no longer qualify for the cash bonus.

Yes. With end-to-end encryption, both you and your customers’ information are protected by the latest authentication technology.

If your business doesn’t need the payments acceptance and processing features that Business Essentials has to offer, you can still use it as your checking account and enjoy all the benefits of a U.S. Bank business checking account. Checking and card payment acceptance are approved separately, and approval for checking doesn’t guarantee approval for accepting payments.

Create a Business Essentials account to get started. By offering Merchant Services, you'll be able to accept credit cards and other electronic payments. The merchant acquiring bank acts as an intermediary between your business and the credit card company, handling payment authentication and other technical aspects. Once the electronic payments are processed and approved, the bank will distribute the funds into your merchant account. It's a seamless way to streamline your payment process and ensure that you're able to accept a variety of payment methods from your customers (including but not limited to credit cards, contactless payment methods, digital wallets and Zelle® payments).

To open a Business Essentials checking account, you’ll need:

Your business’s Employer Identification Number (EIN) or tax ID number, or your Social Security number if you’re a sole proprietorship.

Articles of Incorporation, Articles of Organization or a charter or similar legal document that indicates when your company was formed (not required for sole proprietors).

Social Security number for you and anyone else authorized to sign checks or make transactions on behalf of your company.

Name, email address and phone number for any additional owners with 25% or more ownership in the company.

Yes, this promotion1 also applies to the U.S. Bank Platinum Business Checking Package, which offers extra features for businesses with high balances and transaction volume. Learn more about the benefits, terms and conditions.