Turn your payments into a $400 statement credit.1

Call us today to get started 844-841-1114

Learn about our transaction fee rates so you get the most for your money. Transaction, hardware and sales tax fees may still apply. 1

For physical or tap-to-pay card payments made by customer.

For card payments where you enter manual card details for customer in person or over-the-phone.

For digital or ecommerce purchases online.

2,000+

Branches nationwide

Fortune

2025 Fortune® World’s Most Admired Companies™

$7.8 billion

In small-business and small-farm loans

Ready to get started today? Check out these options below.

Simplify on-the-go payments with our mobile card reader (mobile app included).

Rent or buy a sleek, portable handheld option that lets you take payments anywhere (mobile app included).

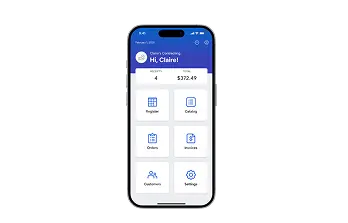

Manage your business while on the go. Access your register, customers and products from your smartphone or mobile device.

Connect with us at 844-841-1114. Monday-Friday 6:00 AM- 6:00pm PDT. Or simply fill out our contact form and we’ll be in touch.

From flexible POS hardware options with no termination fees and fast funding, we help your business payments run more efficiently. Plus, our dedicated live support team is available 24/7 ensuring you get the help you need at any time.

Securely take payments online, in-store and on-the-go for maximum convenience.

Keep your business running smoothly with 24/7 support from a specialist.

Quick access to your funds, including weekends and holidays.3

No hidden fees or long-term contracts, with customized options built around your needs.