Business checking accounts

Earn up to $1,200.

Keep your company safe with fraud-prevention tools.

Transfer funds and pay multiple bills in just minutes.

Connect your third-party accounting, budgeting and tax programs with ease.

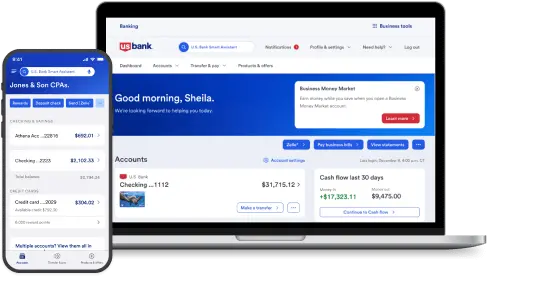

Use a business banking dashboard and cash flow forecasts to manage and optimize your finances.

businesses choose us as their trusted financial partner

Client data as of February 28, 2025

bankers serving small to medium-sized businesses

2025 Fortune® World’s Most Admired Companies™

Qualifying transactions include: Debit card purchases, ACH credits, wire transfer credits & debits, Zelle® credits and debits, U.S. Bank mobile check deposit, U.S. Bank bill pay, or payment received via U.S. Bank Payment Solutions.

Note: You must make all five qualifying transactions within 60 days of opening your account to receive your bonus.

Not eligible: Other transactions such as (but not limited to) other person-to-person payments, transfers to credit card or transfers between U.S. Bank accounts.

You’ll receive your bonus 30 days following the last calendar day of the month after you have met the qualifications.1

Business Essentials bonus qualifications:

Platinum Business Checking bonus qualifications:

Your bonus will be paid out directly to your new U.S. Bank business checking account.

In order to qualify for the bonus promotion, you must maintain the daily balance promotion requirement. Your account will still be in good standing, but you will no longer qualify for the cash bonus.

Yes. With end-to-end encryption, both you and your customers’ information are protected by the latest authentication technology.

If your business doesn’t need the payments acceptance and processing features that Business Essentials has to offer, you can still use it as your checking account and enjoy all the benefits of a U.S. Bank business checking account. Checking and card payment acceptance are approved separately, and approval for checking doesn’t guarantee approval for accepting payments.

Create a Business Essentials account to get started. By offering Merchant Services, you'll be able to accept credit cards and other electronic payments. The merchant acquiring bank acts as an intermediary between your business and the credit card company, handling payment authentication and other technical aspects. Once the electronic payments are processed and approved, the bank will distribute the funds into your merchant account. It's a seamless way to streamline your payment process and ensure that you're able to accept a variety of payment methods from your customers (including but not limited to credit cards, contactless payment methods, digital wallets and Zelle® payments).

To open a business checking account, you’ll need: