Maximizing your infrastructure finance project with a full suite trustee and agent

8 steps to take before you buy a home

Preparing for retirement: 8 steps to take

Evaluating interest rate risk creating risk management strategy

Money Moments: How to finance a home addition

3 reasons governments and educational institutions should implement service fees

Higher education and the cashless society: Latest trends

How to avoid student loan scams

How to fund your business without using 401(k) savings

Working with an accountability partner can help you reach your goals

What to do with your tax refund or bonus

Multiple accounts can make it easier to follow a monthly budget

Webinar: Uncover the cost: Starting a family

What’s the difference between Fannie Mae and Freddie Mac?

4 benefits of independent loan agents

At your service: outsourcing loan agency work

How I did it: Bought a home without a 20 percent down payment

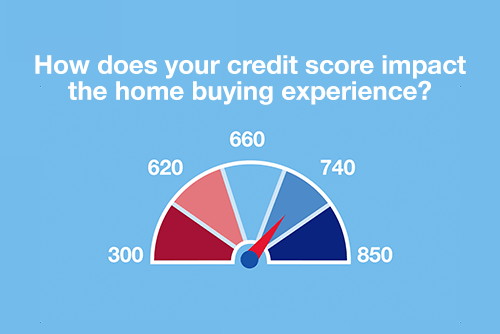

Changes in credit reporting and what it means for homebuyers

Checklist: 10 questions to ask your home inspector

Closing on a house checklist for buyers

How compound interest works

Retirement savings by age

How to build wealth at any age

Good money habits: 6 common money mistakes to avoid

5 tips for parents opening a bank account for kids

Investment strategies by age

These small home improvement projects offer big returns on investment

Webinar: Mortgage basics: Finding the right home loan for you

Dear Money Mentor: What is cash-out refinancing and is it right for you?

Can ABL options fuel your business — and keep it running?

5 financial goals for the new year

How to get started creating your business plan

Collateral options for ABL: What’s eligible, what’s not?

ABL mythbusters: The truth about asset-based lending

Checklist: financial recovery after a natural disaster

Preparing for adoption and IVF

11 essential things to do before baby comes

Webinar: Uncover the cost: Starting a family

Are you ready to restart your federal student loan payments?

Tips for handling rising costs from an Operation HOPE Financial Wellbeing coach

Tips to earn that A+ in back-to-school savings

How to choose the right business checking account

Mindset Matters: How to practice mindful spending

Uncover the cost: Wedding

A who’s who at your local bank

Using 529 plans for K-12 tuition

How to open and invest in a 529 plan

How grandparents can contribute to college funds instead of buying gifts

Managing the rising costs of payment acceptance with service fees

CFO survey: A shifting focus on ESG in business

Middle-market direct lending: Obstacles and opportunities

CFO report: Driving growth via new business models and technology

CFO insights: Leading the recovery for sustainable growth

How jumbo loans can help home buyers and your builder business

Prioritizing payroll during the COVID-19 pandemic

Meet your business credit card support team

5 tips to help you land a small business loan

Streamline operations with all-in-one small business financial support

Make your business legit

How to establish your business credit score

Talent acquisition 101: Building a small business dream team

5 things to know before accepting a first job offer

How to save money while helping the environment

Opening a business on a budget during COVID-19

When to consider switching banks for your business

7 steps to prepare for the high cost of child care

What are conforming loan limits and why are they increasing

How to save for a wedding

How I did it: Turned my side hustle into a full-time job

5 things to consider when deciding to take an unplanned trip

How to talk to your lender about debt

Stay committed to your goals by creating positive habits

5 tips for creating (and sticking to) a holiday budget

How to test new business ideas

How can I help my student manage money?

Bank from home with these digital features

How I did it: Switched career paths by taking an unexpected pivot

Year-end financial checklist

Key components of a financial plan

Achieving their dreams through a pre-apprenticeship construction program

Tech lifecycle refresh: A tale of two philosophies

6 questions students should ask about checking accounts

Beyond Mars, AeroVironment’s earthly expansion fueled by U.S. Bank

Do your investments match your financial goals?

Credit: Do you understand it?

Test your loan savvy

Webinar: Mortgage basics: What’s the difference between interest rate and annual percentage rate?

How to manage money in the military: A veteran weighs in

How do I prequalify for a mortgage?

Can you take advantage of the dead equity in your home?

Webinar: Mortgage basics: How much house can you afford?

Is a home equity line of credit (HELOC) right for you?

Webinar: Mortgage basics: 3 Key steps in the homebuying process

Webinar: Mortgage basics: Buying or renting – What’s right for you?

How to use your home equity to finance home improvements

Webinar: Mortgage basics: What is refinancing, and is it right for you?

Should you get a home equity loan or a home equity line of credit?

6 questions to ask before buying a new home

What is refinancing a mortgage?

What to know when buying a home with your significant other

Webinar: Mortgage basics: How does your credit score impact the homebuying experience?

What is a home equity line of credit (HELOC) and what can it be used for?

Is it the right time to refinance your mortgage?

Overcoming high interest rates: Getting your homeownership goals back on track

Home buying myths: Realities of owning a home

Webinar: 11 insider tips for student debt

10 uses for a home equity loan

Is a home equity loan for college the right choice for your student

How to apply for federal student aid through the FAFSA

U.S. Bank asks: Do you know what an overdraft is?

Tips to overcome three common savings hurdles

Money Moments: 8 dos and don’ts for saving money in your 30s

Helpful tips for safe and smart charitable giving

Growing your savings by going on a ‘money hunt’

Friction: How it can help achieve money goals

It's possible: 7 tips for breaking the spending cycle

What to consider before taking out a student loan

Here’s how to create a budget for yourself

Common unexpected expenses and three ways to pay for them

Are savings bonds still a thing?

Allowance basics for parents and kids

9 simple ways to save

Do you and your fiancé have compatible financial goals?

3 ways to keep costs down at the grocery store (and make meal planning fun)

What military service taught me about money management

Webinar: U.S. Bank asks: Are you safe from fraud?

Learn to spot and protect yourself from common student scams

College budgeting: When to save and splurge

How I did it: Paid off student loans

The A to Z’s of college loan terms

How to save money in college: easy ways to spend less

Costs to consider when starting a business

Questions to ask before buying a car

Should you give your child a college credit card?

Webinar: Uncover the cost: Building a home

Webinar: Mortgage basics: Prequalification or pre-approval – What do I need?

Adulting 101: How to make a budget plan

You can take these 18 budgeting tips straight to the bank

Your financial aid guide: What are your options?

How I did it: Learned to budget as a single mom

An investor’s guide to marketplace lending

What is a CLO?

Your 4-step guide to financial planning

Personal loans first-timer's guide: 7 questions to ask

Dear Money Mentor: How do I set and track financial goals?

Retirement income planning: 4 steps to take

What financial advice would you give your younger self?

Essential financial resources and protections for military families

How to stop living paycheck to paycheck post-pay increase

What you need to know about renting

What’s in your emergency fund?

Certificates of deposit: How they work to grow your money

Dear Money Mentor: How do I pick a savings or checking account?

What you should know about buying a car

What you need to know before buying a new or used car

Take the stress out of buying your teen a car

How to choose the best car loan for you

Practical money skills and financial tips for college students

Personal finance for teens can empower your child

5 reasons why couples may have separate bank accounts

U.S. Bank asks: Transitioning out of college life? What’s next?

Co-signing 101: Applying for a loan with co-borrower

What’s a subordination agreement, and why does it matter?

Understanding the true cost of borrowing: What is amortization, and why does it matter?

How to use debt to build wealth

How to talk about money with your family

How to build credit as a student

30-day adulting challenge: Financial wellness tasks to complete in a month

Money Moments: Tips for selling your home

How I did it: My house remodel

First-timer’s guide to savings account alternatives

Everything you need to know about consolidating debts

Does your savings plan match your lifestyle?

Student checklist: Preparing for college

Webinar: Uncover the cost: College diploma

Your quick guide to loans and obtaining credit

U.S. Bank asks: Do you know your finances?

Break free from cash flow management constraints

Webinar: Uncover the cost: Home renovation

Webinar: Bank Notes: College cost comparison

4 questions to ask before you buy an investment property

Parent checklist: Preparing for college

Webinar: 5 myths about emergency funds