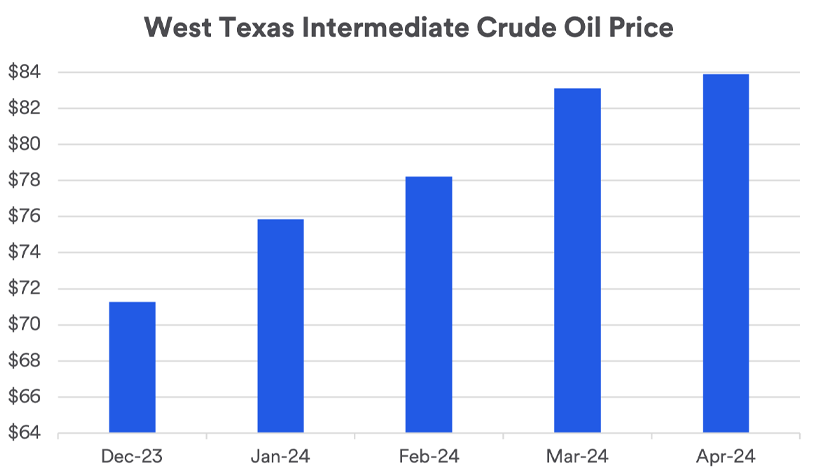

Energy price drops played a major role in inflation’s decline from a peak of 9.1% for the previous 12-month period as of June 2022, to 3.2% for the 12-months ending in February 2024, as measured by the Consumer Price Index.1 However, inflation has lingered above 3% since 2023’s summer months, and the recent oil price rise is likely contributing to persistent elevated inflation.

Will supply chain issues again become a flashpoint for the markets given the ongoing conflict in the Middle East and other potential issues?

Evolving supply chain concerns

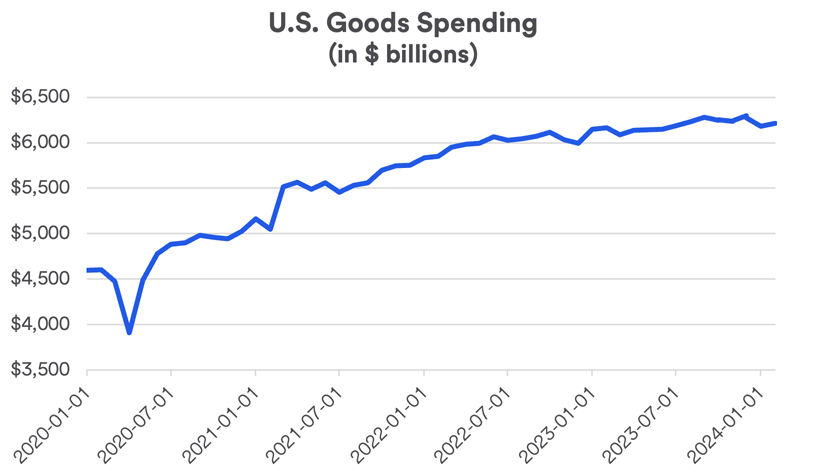

Potential supply chain issues in 2024 differ from what initially sparked inflationary concerns in 2021. At that time, pent-up consumer demand spiked following the economy’s “shutdown” phase, due to the COVID-19 pandemic. As consumers ramped up spending, supported by emergency government support programs to households and businesses, the global economy faced a shortage of commodities, parts or products that resulted in a supply-demand imbalance, forcing prices higher.

“Higher inflation reflected a restricted supply of goods at the same time that there was strong demand for many of those same goods,” says Tom Hainlin, national investment strategist at U.S. Bank. Energy and food products were leading drivers as inflation soared. The war between Russia and Ukraine, for a time, interrupted some shipments of energy and agricultural commodities from both countries. China's COVID-19 lockdown policies, which were in place until late 2022, hampered manufacturing and shipment of goods from Chinese firms.

Yet supply chain issues affecting a wider range of products also contributed to the problem. Some companies had difficulty keeping up with demand, sourcing components needed to manufacture products or finding enough workers to fill production needs. In addition, transportation challenges arose, including a backup of shipping traffic in some ports and a shortage of truckers to haul freight over long distances.

For the most part, the worst of these challenges have subsided. Manufacturer supplies improved and consumers are finding most goods readily accessible. The economy also transitioned from one driven by demand for goods to increased spending on services, including travel and entertainment.

“Goods demand flattened out beginning in 2022,” says Haworth. “Inflation today is much more visible for services than for goods, based on recent Consumer Price Index data.” The slowdown in the growth of goods demand has put less stress on supply chains. “Durable good sales are also affected due to higher costs of borrowing to purchase big ticket items like automobiles,” says Haworth. Tempering demand to cool inflation was part of the Federal Reserve’s strategy in raising the federal funds target rate it controls eleven times in 2022 and 2023.