Volatility essentially measures the degree to which the price of an investment changes. Generally speaking, bonds are considered less volatile than stocks, though bonds can also experience price volatility, as bond prices can rise or fall during periods of interest rate changes. Different types of stocks or stock asset classes can also demonstrate different levels of price volatility.

Key takeaways

Market volatility happens from time-to-time and can be caused by unexpected economic news, changes in monetary policy as set by the Federal Reserve, and political/geopolitical events, to name a few.

Having a financial plan in place, re-examining your risk tolerance and an appropriately diversified portfolio can help you prepare for and better weather market volatility.

Working with a financial professional can be beneficial, as they can help you adjust your plan to protect your assets or take advantage of new opportunities.

If history is a guide, there will always be periods of market volatility, with dramatic swings both up and down. While not uncommon, these times can be anxiety-producing for investors. Your portfolio may be negatively affected, and you may question whether you need a different financial strategy.

Understanding market volatility and its potential causes may help you better manage the emotions and behaviors that come with it. Another key ingredient to handling market volatility is having a financial plan. A comprehensive plan is designed to reflect the financial goals you ultimately want to achieve and to help you stay on track in a turbulent market.

What is market volatility?

The markets sometimes experience sharp and unpredictable price movements, either down or up. These movements are often referred to as a “volatile market” and can occur over a period of days, weeks, or months. You should expect volatility from time-to-time, but it’s important to note that these tend to be temporary stages in the markets. In fact, a market decline can provide investors a good value in specific investments that experience a temporary drop.

You should expect volatility from time-to-time but remember that these tend to be temporary stages in the markets. In fact, a market decline can provide investors a good value in specific investments that experience a temporary drop.

While the term “volatility” applies to both up and down market movements, investors tend to be more concerned about downside volatility. A slide of 10% or more in a major market index (Dow Jones Industrial Average, S&P 500, NASDAQ Composite) is considered a “market correction.” A decline of 20% or more is considered a “bear market” (an increase of 20% or more after a bear market is known as a “bull market”).

What causes market volatility?

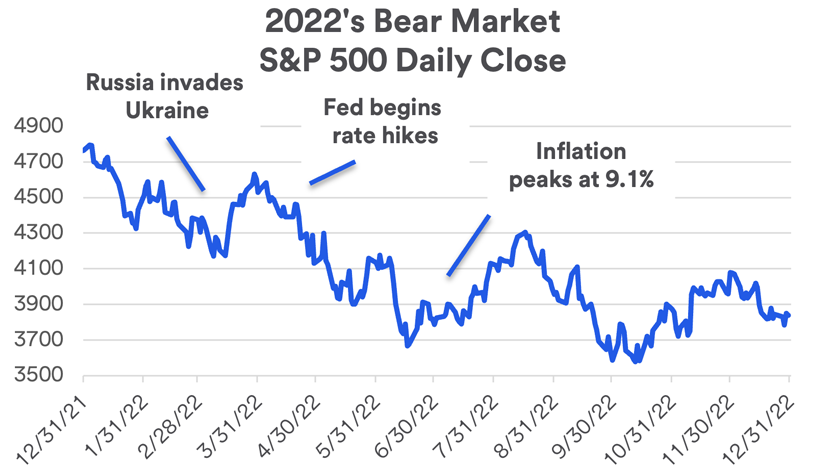

While market volatility can happen suddenly, with little warning, it rarely occurs for no reason. Causes of a volatile environment vary. For example, a series of events seemed to contribute to the 2022 bear market.

- Surprising economic news that differed from the expectations of investors (in this case, a sudden inflationary spike as measured by the Consumer Price Index).

- A sustained change in monetary policy, such as the Federal Reserve announcing plans to raise short-term interest rates, which occurred in March 2022 in response to rising inflation.

- Geopolitical events such as Russia's invasion of Ukraine in February 2022, creating a range of economic impacts with ramifications for global markets.

Other factors can cause market volatility, including:

- Political developments including unexpected election results, an event such as a government shutdown or passage of key legislation designed to give the economy a boost.

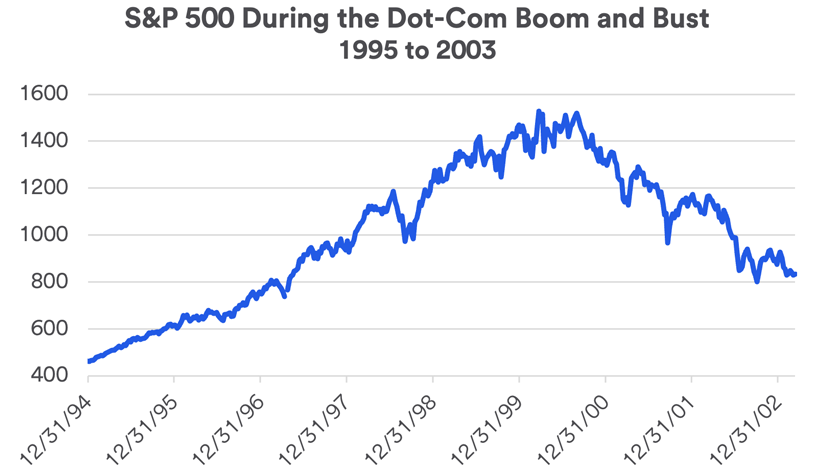

- Events specific to markets, such as stocks becoming overvalued or a company reporting a surprisingly positive earnings result. Following a major market runup in the 1990s, markets experienced significant volatility, mostly to the downside, beginning in 2000. At this point, a number of overpriced “dot-com” stocks faced a sudden and dramatic selloff as investors became concerned that prices had outdistanced underlying company fundamentals.

5 steps you can take when the market is volatile

While it’s essential to maintain a proper perspective during these periods, there are steps you can take to help you better prepare for market volatility in the future.

1. Establish or revisit your financial plan

A financial plan is “the foundation of investing,” says Eric Freedman, chief investment officer for U.S. Bank Wealth Management. Freedman emphasizes that sticking with a plan helps avoid the desire to move money in an out of the market in reaction to price changes. “Investors often find that market timing doesn’t result in a favorable outcome.”

As you create or review your plan, here are specific actions to consider:

- Take a closer look at your financial goals and your time horizon to reach those goals. If they’re no longer realistic, make adjustments so you can stay on track to meet your most important goals.

- Review your monthly budget to assure you’re comfortable with your income and expenditures. You want to be able to cover essential expenses at all times.

- If necessary, try to identify ways to set additional dollars aside toward your most important financial goals.

2. Bolster your emergency fund

Your emergency cash savings serve as a financial cushion through difficult times or to help you meet unexpected expenses. The conventional wisdom is that you should have the equivalent of three-to-six months’ worth of income readily available to tap for an immediate need should it arise.

If your income is subject to greater fluctuation in economically challenging periods or just by the nature of the work you do, consider bumping up your emergency cash cushion to six-to-nine months or longer. It will provide greater financial flexibility to help you get through challenging periods.

3. Re-assess your risk tolerance level

Your investment strategy is derived in large part from the level of risk you’re willing to take. From time-to-time, you’ll want to reexamine your views on investment risk.

Answers to these questions can help you more accurately assess your risk tolerance level:

- Are you willing to accept moderate losses in your investments over a period of time and demonstrate the patience needed to overcome those setbacks? If you are, you could position your investments in a portfolio mix that may endure more significant short-term volatility, but with the potential opportunity for higher, long-term returns.

- Do you become uncomfortable and nervous about your portfolio during down markets? If so, you may want to reduce the amount of risk in your portfolio and choose a more conservative portfolio mix. For example, investors may be able to take advantage of today’s higher bond yields to build a portfolio positioned to generate a more competitive income stream. That may allow them to position more assets in bonds and manage risk more conservatively by reducing equity positions.

- What is your time horizon to retirement? If you’re nearing retirement age (within five years or less), you may want to scale back the amount of risk in your portfolio to avoid any significant losses that could occur just before or once you’re in retirement. By contrast, if you’re 20 years or more away from retirement, time is on your side. You may be in a better position to take on more risk in order to potentially earn a higher return and ride through the market’s challenging periods.

4. Make sure your portfolio is properly diversified

A diversified portfolio that better weathers market volatility begins with owning an appropriate mix of investments aligned with your risk tolerance level. The mix of assets you hold should represent three broad investment categories – stocks, bonds and cash. Diversify further within each category through different investment types.

With stocks, you may want to include small-, medium and large-cap stocks along with international stocks. You may want to include some combination of growth and value stocks, as well as specific industry sectors in your asset mix. With bonds you may want to consider government bonds, corporate bonds, and bonds of different maturities.

“In the current environment, economic trends such as GDP growth, inflation and interest rates seem on a relatively stable course,” says Rob Haworth, senior investment strategy director at U.S. Bank Wealth Management. “It’s leading many investors to maintain a rather neutral weighting in their asset allocation mix.” For those who still have a sense of caution about the stock market, “a dollar-cost averaging strategy is an effective way to help mitigate the risk of short-term market volatility when you put money to work in assets that can fluctuate in value,” adds Haworth.

Reassess your portfolio at least annually to determine if it would be beneficial to make any adjustments. As your portfolio rises or falls in value due to varied investment performance, you may want to rebalance it to ensure it remains aligned with your primary objectives.

5. Talk with your financial professional

In the near term, investors should prepare for additional market volatility. “The markets are likely to continue the up-and-down pattern we’ve seen in the early months of 2024,” says Haworth. An experienced financial professional can review your current plan or guide you through the process of developing a plan to help you gain confidence that you’re on track toward your financial goals.

Even if you’re currently comfortable with your plan and investment portfolio, the economic environment can quickly change. A financial professional can help assess your circumstances and calibrate your plan as necessary to either help protect your financial position or take advantage of new market opportunities.

Your financial goals are the foundation of your financial plan. Learn about our goals-focused approach to wealth planning.

Frequently asked questions

Stock markets tend to be subject to less price volatility when the underlying economy is fairly stable. That often occurs during times of steady economic growth and modest inflation. Stock prices are ultimately a measure of the strength of a company’s earnings (profits). If earnings are growing steadily due to a favorable economic environment, markets tend to encounter fewer periods of volatility. Markets are prone to increasing volatility if a more unpredictable economic environment occurs or unexpected events develop.

Tags:

Related articles

How to determine risk tolerance

Your time horizon and emotional response to market volatility are key factors in helping you assess your risk tolerance.

How to set financial goals

Setting and working toward financial goals becomes easier when you reflect on your intentions.